- Profit-taking in gold was seen on Friday amid signs of stability in financial markets.

- With hopes for diplomacy in Ukraine, risk appetite grew, and metal prices rose.

- On a dip, the setup still favors bulls and supports the prospect of some buying.

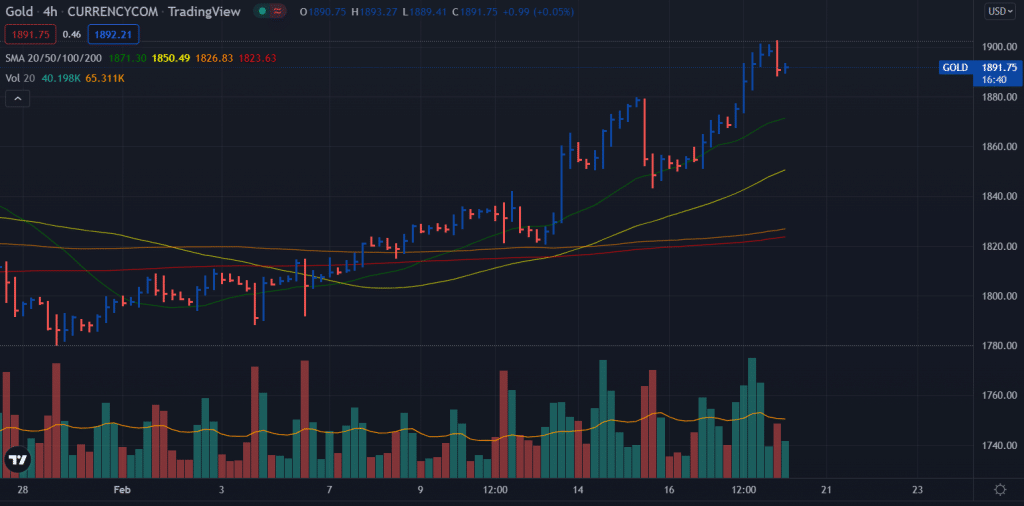

The gold forecast is bullish as the risk-off sentiment gives room to the bulls. The Russia-Ukraine headlines will guide the market. Earlier this Friday, the gold price reached its highest level since June 2021, above $1,900, but has since dropped from that level.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Anthony Blinken accepted Russia’s invitation to meet with Foreign Minister Sergei Lavrov later this week and expressed hope for diplomatic solutions to the East-West standoff over Ukraine. Temporary stabilization of global risk sentiment was a key factor in undermining the safe haven XAU/USD. While there is a downside, fears of a Russian invasion of Ukraine keep the downside in check.

Liz Truss, Britain’s Foreign Secretary, dismissed the Russian claims of troops being withdrawn on Thursday and said troop building up in Ukraine shows no signs of slowing down. The British Prime Minister Boris Johnson and US President Joe Biden also accused Russia of fabricating a pretext to invade Ukraine. According to Russian media, rebels in eastern Ukraine have accused government forces of shelling their territory. In response, Ukraine denied the allegations, hinting that it might have been a false flag operation designed to discredit Ukrainians.

According to Russia’s Defense Ministry, ten convoys left Crimea after the exercise, and a video showing a logistics unit returning to its base was released. According to the latest US satellite imaging company Maxar Technologies, some Russian equipment has been removed from the Ukrainian border. Markets could be dampened by conflicting headlines. Additionally, uncertainty about the Fed’s tightening plans might be a tailwind for gold prices, limiting a significant decline.

As evidenced by the minutes of the January 25-26 FOMC meeting published on Wednesday, most policymakers agreed that it would be appropriate to exit policy sooner than expected if inflation did not fall as expected. Moreover, recent geopolitical developments have dashed hopes of a rate hike in March of 50 basis points. Gold and caution bearish traders may benefit from this additional support. Therefore, the recent sharp rise needs to be followed by any strong subsequent selling before confirming that it is over.

For now, XAU/USD has broken a two-day winning streak, though it continues to climb for the third consecutive week. The US Existing Home Sales data will be released in the early North American session. In conjunction with US bond yields, this will impact US dollar prices and add to commodity prices. Meanwhile, attention will remain on the headlines surrounding Russia-Ukraine relations, which will continue to boost demand for traditional safe-haven assets, including gold.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Gold price technical forecast: Bears find no respite

The gold price failed to sustain gains above $1,900. The 4-hour chart shows an upthrust bar at the top. However, this cannot be considered a bearish reversal unless we see a follow-up price behavior and volume data. The upthrust has a very low volume, indicating no respite for the bears. However, the upside may find further stiff resistance at $1,920.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money