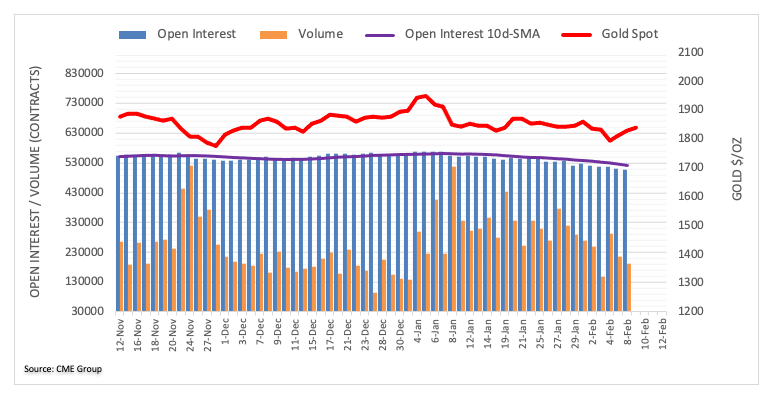

CME Group’s preliminary figures for gold futures markets noted open interest shrunk for the second consecutive session on Monday, this time by almost 2K contracts. In the same line, volume went down for the second straight session, now by around 26.1K contracts.

Gold could re-test the 200-day SMA near $1,850

Gold prices edges higher at the beginning of the week, extending the rebound from Friday’s 2021 lows near $1,780. The move, however, was on the back of shrinking open interest and volume and hints at the idea that a correction lower could be in the offing. That said, the precious metal is expected to falter around the key 200-day SMA just above $1,850 per ounce troy.