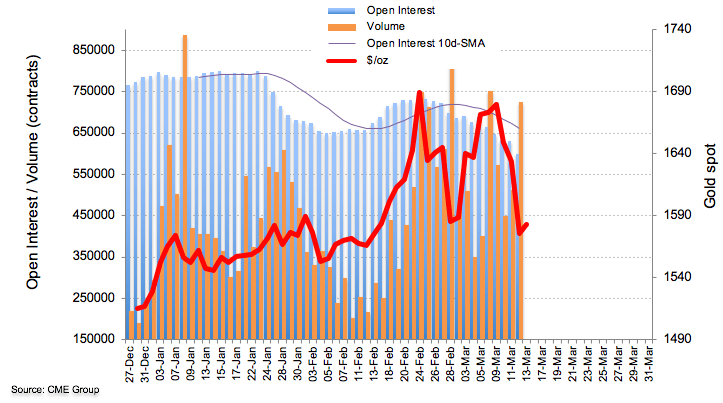

CME Group’s advanced readings for Gold futures markets noted traders scaled back their open interest positions once again on Wednesday, this time by around 29.2K contracts. On the other direction, volume rose for the second consecutive day, this time by almost 212K contracts, the largest single day build since February 28th.

Gold: Decent contention emerges around $1,550/oz

The ounce troy of the precious metal remains under heavy selling pressure so far this week. Thursday’s sharp pullback was amidst the firm downtrend in open interest, which should mitigate the downside potential at least in the very near-term. However, the significant uptick in volume seems to be favouring a deeper decline. On the latter, decent support is seen in the $1,550/oz area, where coincide February lows and a Fibo retracement (of the December-march rally).