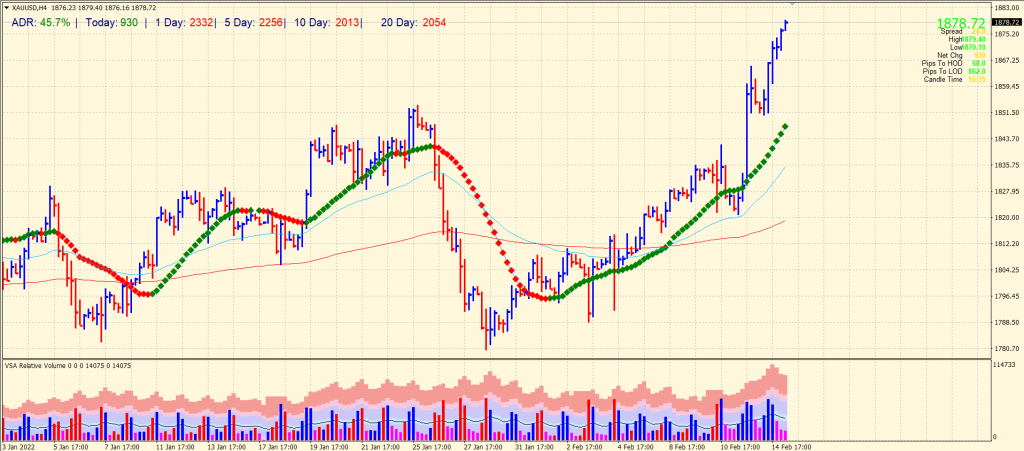

- As gold nears $1900, it retraces an 8-month high and shows a 3-day uptrend.

- Lower earnings accompany reports of a Russian invasion of Ukraine, giving shoppers hope.

- For bulls to continue, the price must not lose a key level of $1,880 because of hawkish Fedspeak.

The gold price outlook is bullish as the risk aversion is quite high amid the Russia-Ukraine conflict, which boosts the metal as a safe haven. The XAU/USD price has supported the market’s appetite for risk protection, rising to a multi-day high near $1,880 ahead of Tuesday’s European session, around $1,878 at press time.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Talk of faster Fed rate hikes and concerns about a Russian invasion of Ukraine are both causing traders to turn to gold. Another factor favoring gold buyers is a weaker US Dollar Index (DXY), supported by lower Treasury yields.

There was a recent upsurge in gold prices due to reports broadcasting satellite imagery of numerous pre-war operations near the Ukrainian-Russian border.

Additionally, comments made by St. Louis Fed president James Bullard impact risk appetite. He cited rising inflationary pressures in the last four inflation reports to reiterate his call for a 100 basis point rate hike by July 1.

Nonetheless, US Treasury yields cemented the previous day’s rebound with a renewed decline to 1.979%, down 1.7 basis points (bp), while S&P 500 futures posted modest gains as of press time. Bond coupons rallied on Monday after falling from a 2.5-year high on Friday despite slightly positive results earlier in the week.

In addition, US January Producer Price Index (PPI) is projected to be 9.1% y/y versus 9.7% y/y, and the Empire State Manufacturing Index figures for February at 12 versus -0.7% y/y, according to market consensus, will be considered throughout the day. Nevertheless, we will focus on the headlines of Russian-Ukrainian news and Fedspeak.

Gold price technical outlook: Bulls to test $1,900

The gold price is slowly gaining towards the key psychological level of $1,900. The price must close above the $1,880 area on a daily basis for bulls to continue. The price is quite far above the 20-period SMA (4-hour chart), which may pull the price back towards the $1,860 area.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

However, the volume is showing a bullish price action. The average daily range is 45%, indicating high volatility on the day. The price may consolidate gains ahead of further bullish continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money