Having reached the highest level since September 2011 at $1818.17 on Wednesday, gold has entered a phase of bullish consolidation before witnessing a fresh leg higher. Technically, the path of least resistance is to the upside on a decisive break above the critical $1820 level.

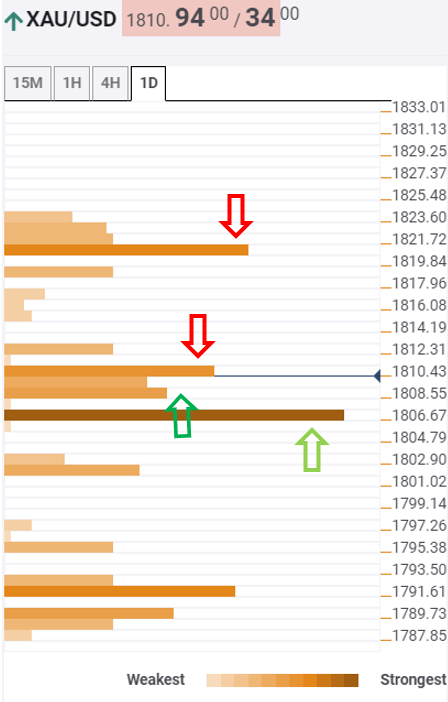

According to the Technical Confluences Indicator, the yellow metal is flirting with the resistance at $1810.50, where the Bollinger Band one-day Upper, previous high 4H and SMA50 15-minutes.

The next resistance is a crucial one for the bulls at $1820, a break above which could trigger an extensive rally towards $1850.

Alternatively, any corrective downside could find a temporary cushion at $1808, the convergence of the previous low one-hour, Fibonacci 38.2% one-day and Bollinger Band one-hour Middle.

Meanwhile, strong support at $1806.60, the intersection of the previous low four-hour and pivot point one-week R2, is the level to beat for the bears in the intraday trading.

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence