- Gold prices snap two-day winning streak while stepping back from short-term horizontal resistance.

- Weekly low, 200-HMA restricts short-term downside.

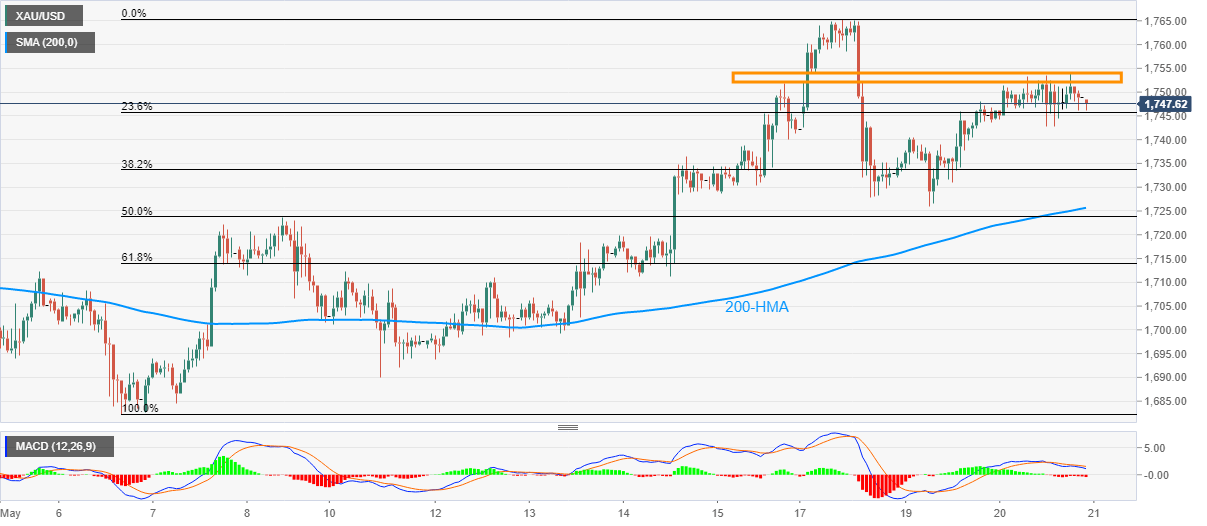

Gold prices register another pullback from the key $1,752/54 horizontal resistance while taking rounds to $1,747.50 during Thursday’s Asian session.

That said, sellers are likely targeting $1,740 as immediate support during the further declines. However, the weekly low and 200-HMA around $1,726/25.50 might challenge additional weaknesses.

Should the precious metal drop below $1,725.50, May 08 top near $1,723.70 could probe the bears before offering them $1,714 rest-point comprising 61.8% Fibonacci retracement of May 06-18 upside.

Alternatively, a clear break of $1,754 will have to successfully cross the recent high of $1,765.38 to challenge the year 2012 top surrounding $1,796.

Gold hourly chart

Trend: Pullback expected