Gold is trying hard to extend the bounce from Wednesday’s slide to $1925 region, as the US dollar clings onto the post-FOMC minutes gains despite the weakness in the Treasury yields.

The risk-averse market conditions amid doubts over the US economic recovery continue to offer support to the metal ahead of the US Jobless Claims data. How is gold positioned technically?

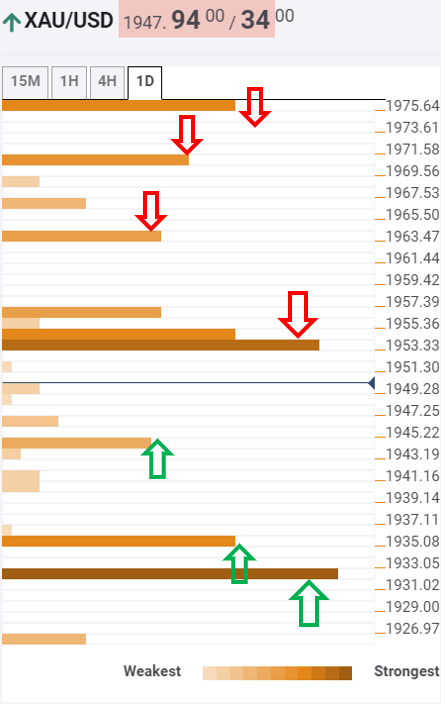

Gold: Key resistances and supports

The tool shows that gold is ranging below the powerful resistance around $1955, where the previous high and SMA5 on four-hour coincide.

Above that hurdle, the price could battle $1957, the convergence of the Fibonacci 61.8% one-day and Bollinger Band 15-minutes Upper.

Acceptance above the latter could trigger a fresh uptick to the next target at $1963, the SMA5 on one-day.

Further north, $1970 will be put to test, which is the confluence of the SMA100 one-hour and Bollinger Band one-day Middle.

To the downside, the immediate cushion is seen at the Fibonacci 23.6% one-day at $1944, below which the Fibonacci 38.2% one-week at $1935 will get tested.

The buyers could remain hopeful so long as it holds above the critical $1931 support, which is the Fibonacci 23.6% one-month.

Here is how it looks on the tool

About the Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence