- Gold prices remain in the hands of the bears, targetting structure around $1,806.

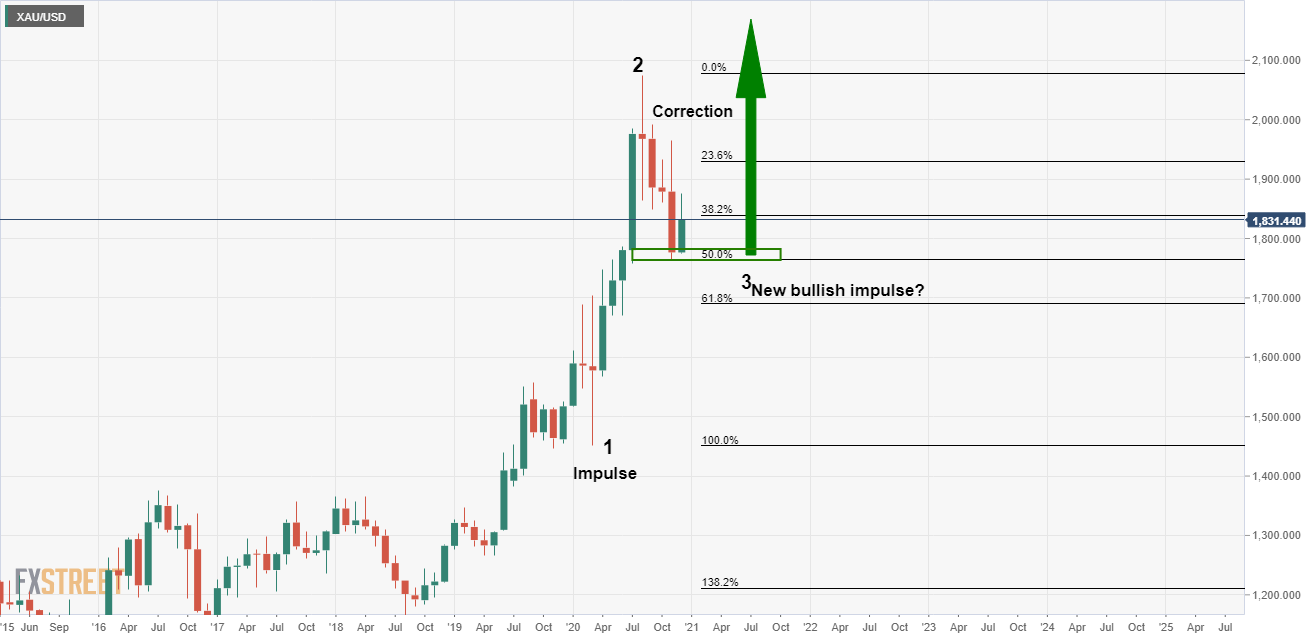

- Hedge funds have added longs and monthly impulse-correction-impulse scenario is compelling.

Further to yesterday’s analysis, the price continues to paint a bearish bias, for the near term, towards a test of the W-formation’s nose at $1,818 with a naked 24th Nov session volume’s point of control at $1,805.90.

For a recap of the prior analysis, see here: Gold Price Analysis: Bears in control, but hedge funds are piling back in

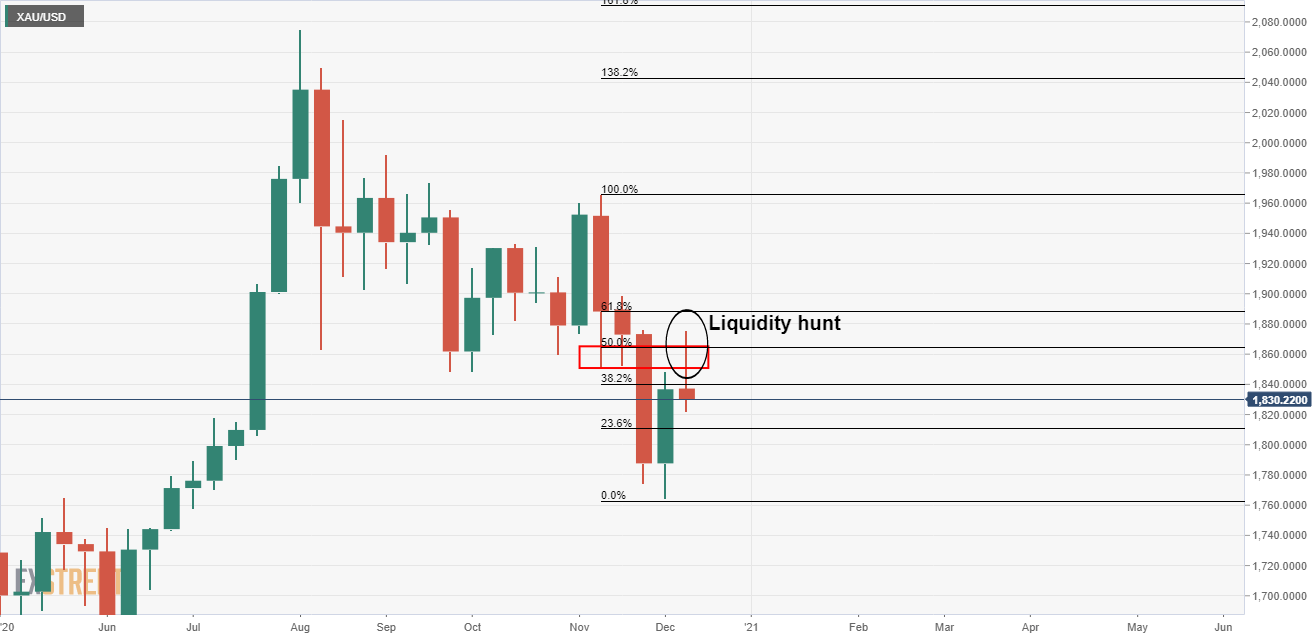

What is most compelling is that we have already seen a major liquidity hunt on the weekly time frame:

This means that the market has eaten up the buy stops and driven the price lower on selling volumes.

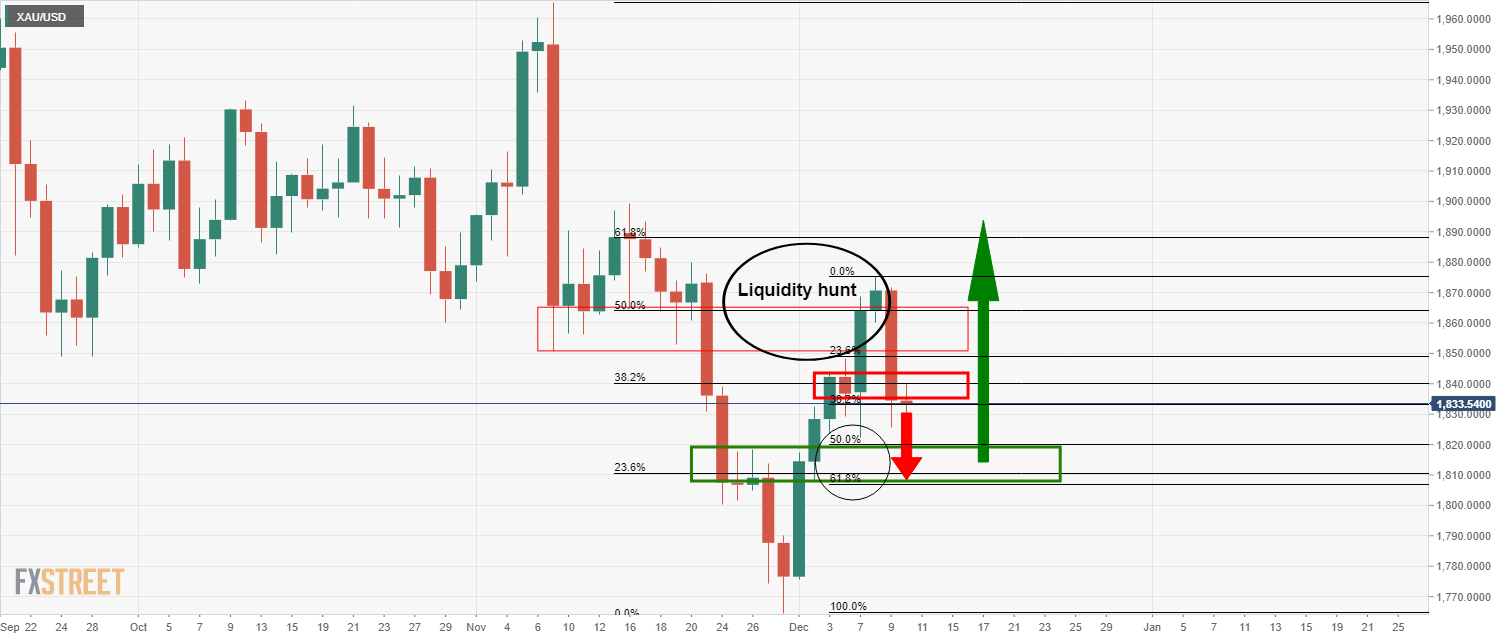

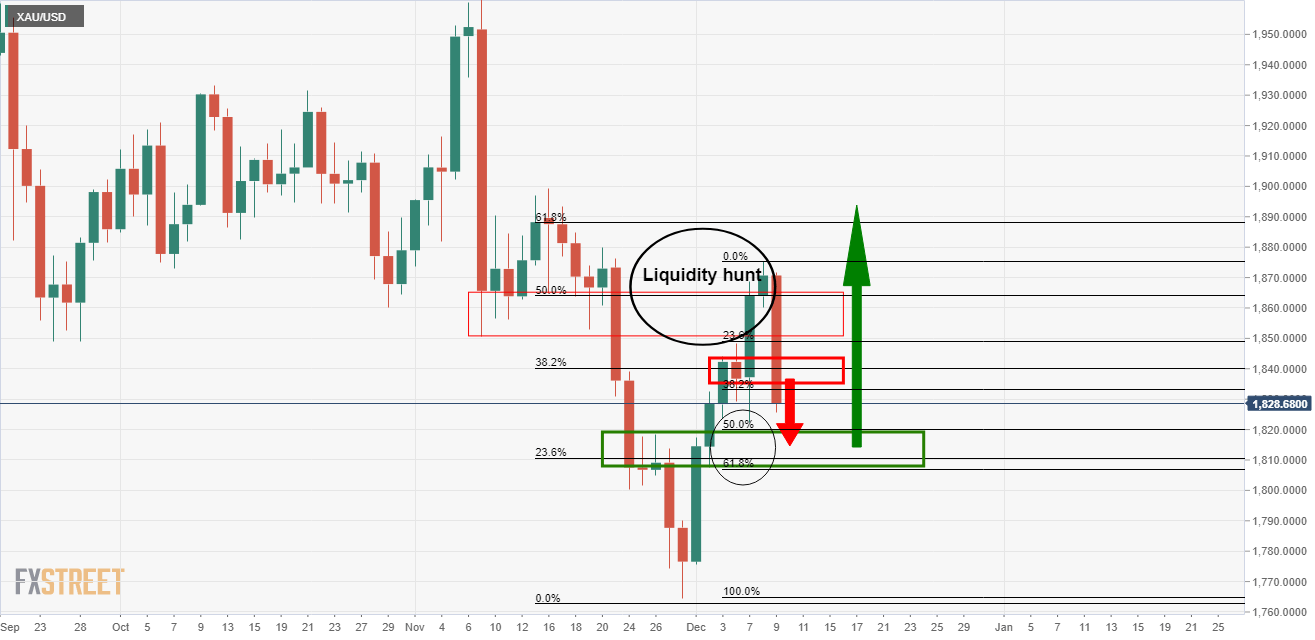

Daily chart

As illustrated between these two daily charts, today’s (above) and the prior day’s, (below), we can see that the price action is moving according to the analysis’s expectations.

With less than three hours until this current bearish daily candle’s close, the bias is still weighted towards the downside and target of the confluence of a 61.8% Fibonacci retracement, structure and volume.

As explained in the prior analysis, there are prospects for an upside trend from the $1,806 structure based on the latest positioning data.

However, a break below the structure opens the 30th November naked point of control at $1,771.

This volume node has not been re-traded since. It is, therefore, a compelling level where the highest numbers of transactions were agreed around the current bearish cycles lows.