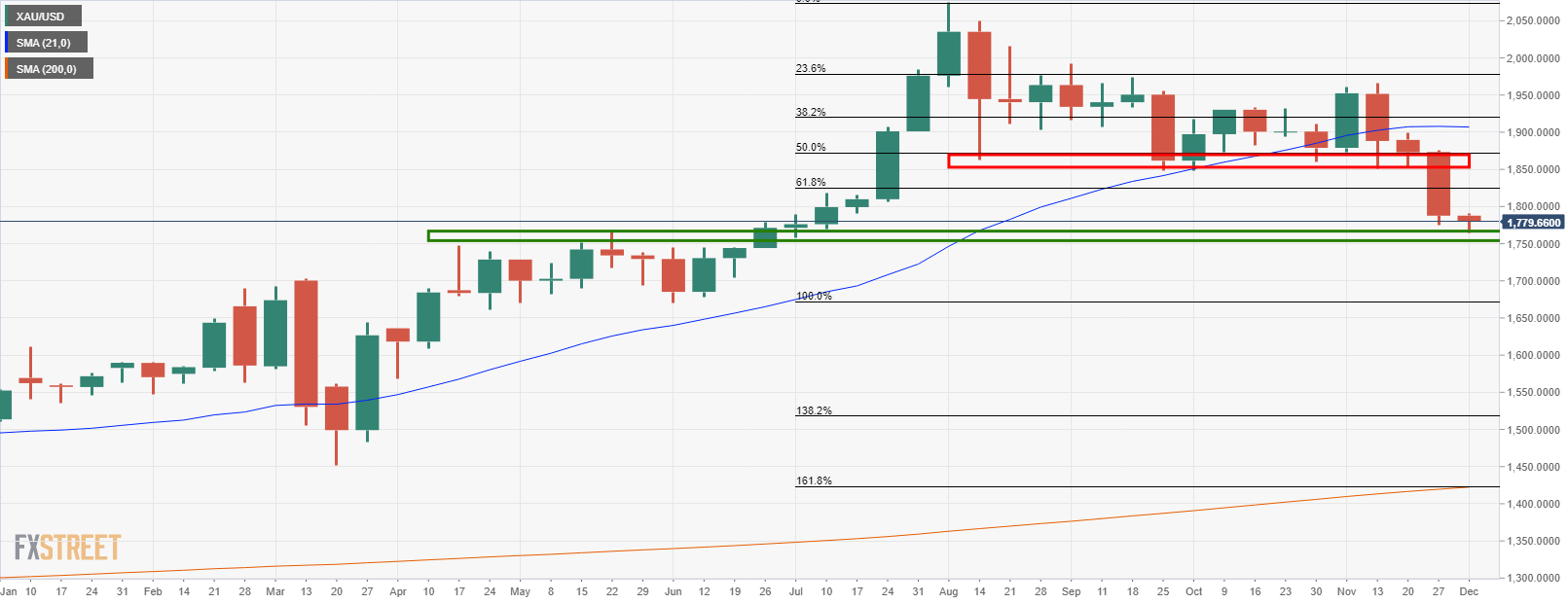

- Gold is technically under pressure on the charts, breaking below key levels.

- However, the bulls have not given up hope and justify their viewpoints based on real interest rates and the US dollar.

Gold is currently trading at $1,779.10 between the day’s range of $1,764.73 and $1,800.70, down some 0.46% at the time of writing.

The price is firmly below the psychological $1,800 level as the market continues to unwind the risk-off trade that had benefitted gold so well over the course of the year:

However, risk markets retreated at the start of the day as month-end flows dominated activity, which helped to support the precious metal on Monday, despite a tentative bid in the greenback.

With growing signs that the US recovery is losing momentum as Q4 progresses, traders are pulling in the reigns in the global stock markets, regardless of the welcomed news of an imminent vaccine.

The state of play for the forthcoming month and next several weeks for stock markets has been explained in the following S&P 500 Index weekly forecast:

- S&P 500 Weekly Forecast: Investors getting set for the Santa-Clause rally built on a house of cards

It’s been a very strong month for both commodities and the stock market, supported by liquidity from central banks, the likelihood of a swift roll-out of the covid vaccines and the prospects of continued fiscal stimulus.

Meanwhile, there will be a keen focus on the Federal Reserve’s Chairman, Jerome Powell, who will appear before the Senate Banking Committee on Tuesday.

”Markets are keenly watching for any indication that the Fed might adjust the quantity or composition of its QE purchases when it meets mid-December,” analysts at ANZ Bank explained.

”In Europe, the deflationary consequences of the economic crisis continue to be felt, reinforced by the recent wave of lockdowns,” the analysts added, which, combined with prospects of a weaker dollar, should play into the hands of the bulls when it comes to investing in gold.

In this context, analysts at TD Securities noted that ”real rates haven’t managed to rise further, while the broad dollar continues to print new lows”.

”We continue to expect that continued recovery will fuel investment appetite in gold as an inflation-hedge asset. Meanwhile, we expect that the Fed will ease by extending the weighted average maturity of its Treasury purchases, ultimately increasing the effectiveness of QE.”

The analysts argued that, in the above scenario, ”this should cap the rise in nominal rates, while inflation expectations should continue to firm as a result of the vaccine and global recovery. As real rates resume their downward trajectory, we expect investment inflows into precious metals to rise substantially, supporting gold prices north of $2,000/oz.”

In the same vein, analysts at ANZ bank said, ”the improving global growth pulse is likely to remain a headwind for the gold market. But it doesn’t mean the end of the current bull run.”

”We believe gold’s other main drivers, real interest rates and the US dollar are likely to provide support over the coming year.”