Gold (XAU/USD) attempts a dead cat bounce towards $1900, having witnessed a massive turnaround on Monday. The metal slumped almost 5% to six-week lows at $1850 after Pfizer Inc’s COVID-19 vaccine trial success alongside other companies’ likely vaccine approval revived hopes of a solid global economic recovery.

The vaccine optimism led markets to rethink the need for a fiscal and monetary policy stimulus, thereby, boding ill for the inflation-hedge, gold. Further, the risk-on rally in the global stocks lifted the Treasury yields, which in turn, powered the dollar bulls.

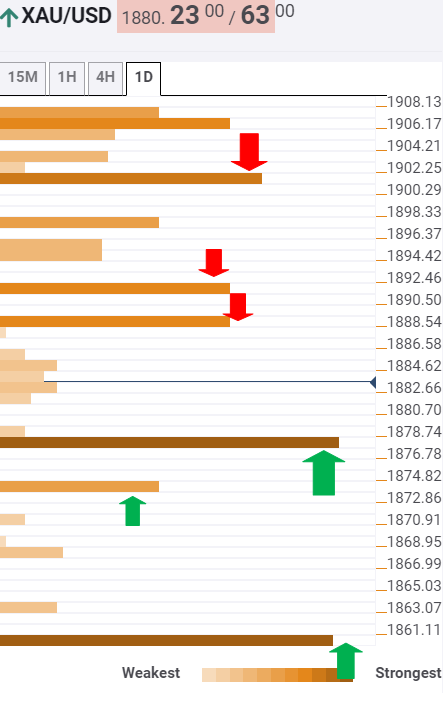

How is gold positioned technically?

Gold: Key resistances and supports

The Technical Confluences Indicator shows that the yellow metal’s recovery ran into fresh offers below the $1889 barrier, which is the Fibonacci 38.2% one-month.

A break above which the immediate cap appears at $1891. Follow-through buying interest could prompt the bulls to take on the significant resistance at $1902, the confluence of the SMA200 four-hour, SMA100 and 10 one-day.

Meanwhile, a dense cluster of healthy resistance levels around $1906 will be put to test if the buyers regain control. That level is the meeting point of the Fibonacci 61.8% one-month and one-week.

To the downside, strong support awaits at $1878, where the Fibonacci 23.6% one-month and one-day coincide with the Bollinger Band 15-minutes Middle.

A failure to hold above the latter could expose the minor cap at $1873, the previous week low.

A sharp decline cannot be ruled out on an acceptance below the aforesaid level, opening floors for a test of the previous month low at $1860.

Further south, a test of the $1849 September 28 low remains on the cards.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence