- Gold registers a five-day winning streak.

- An ascending trend line from mid-March questions further upside.

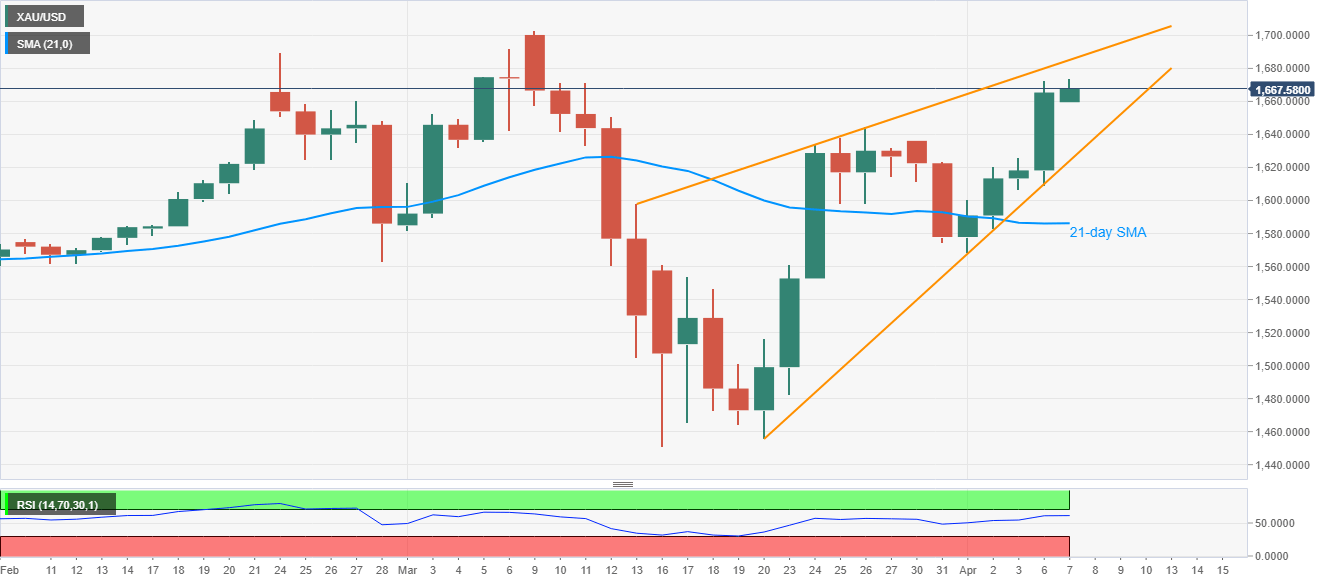

- 21-day SMA will validate the rising wedge bearish technical formation.

Gold prices remain on the front foot while taking the bids near $1,668, up 0.70%, amid the Asian session on Tuesday. In doing so, the bullion refreshes the four-week high with an intraday peak of $1,674.15 while also marking a fifth consecutive daily gain.

While the yellow metal’s sustained trading beyond March 26 top suggests its further upside, an ascending trend line since March 13, 2020, seems to be the immediate resistance to watch.

Should the safe-haven manage to cross $1,685, the previous month high surrounding $1,703 will be on the buyers’ target list during the further advances.

On the downside, the metal’s declines below March 26 high around $1,645 can drag the quote to a short-term rising support line around $1,624.

However, a downside break of $1,624 will confirm the bearish technical pattern that will get validation from the 21-day SMA level of $1,586.

Gold daily chart

Trend: Bullish