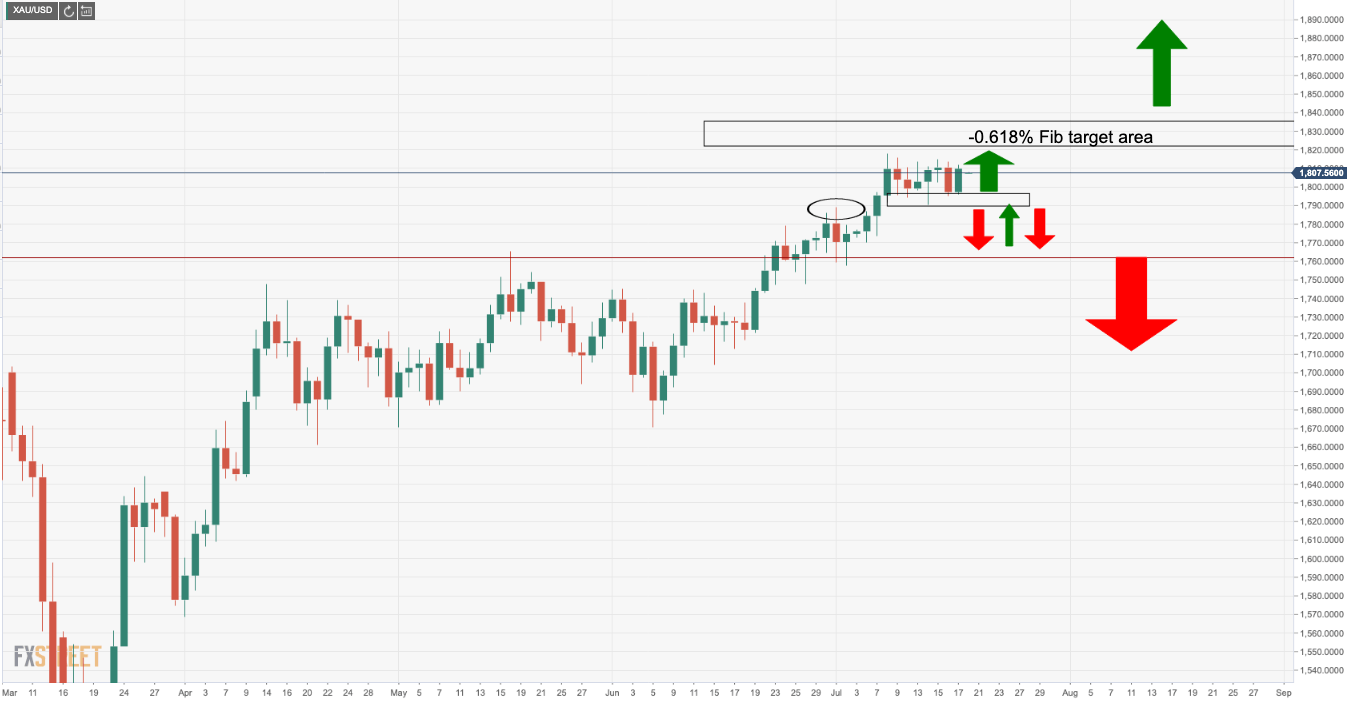

The price of gold is on route to target a -0.618% Fibonacci extension of the corrective leg that came before the weekly impulse to current highs.

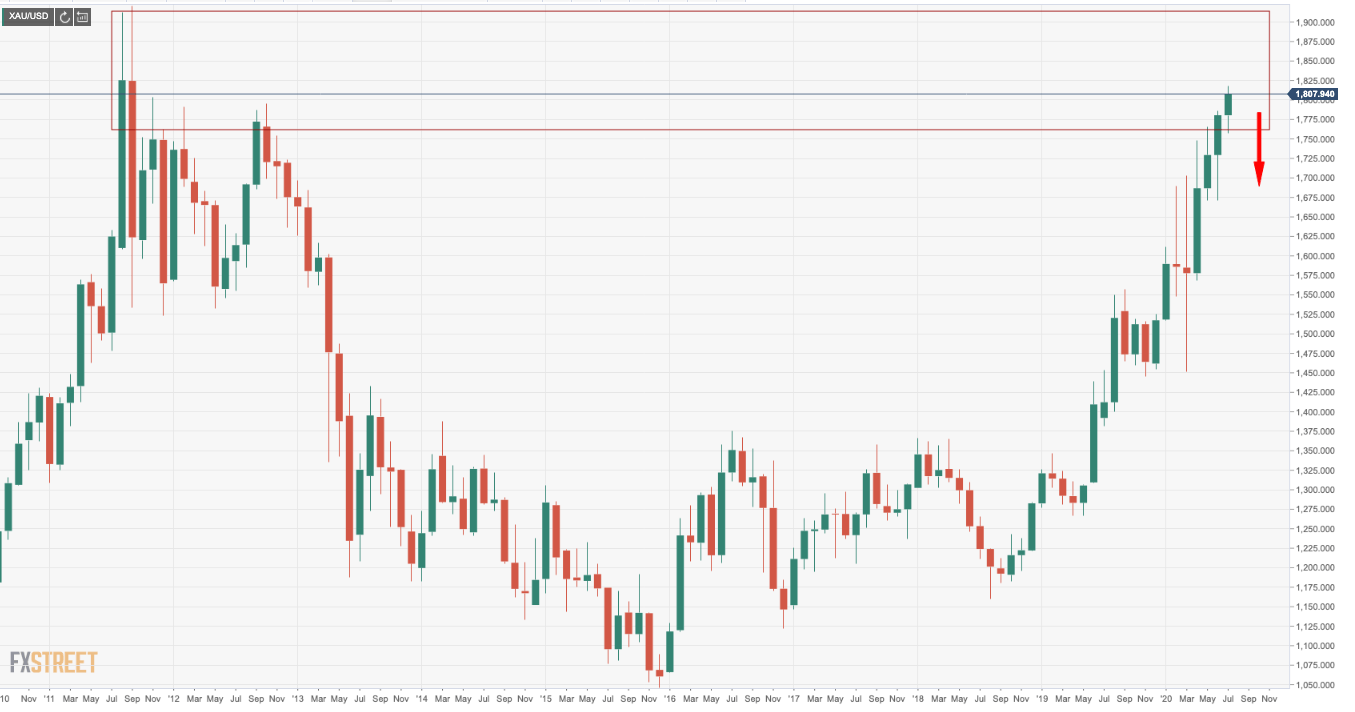

Fro a top-down analysis. we can see that bulls are tempting the hands of the bears at a critical supply zone.

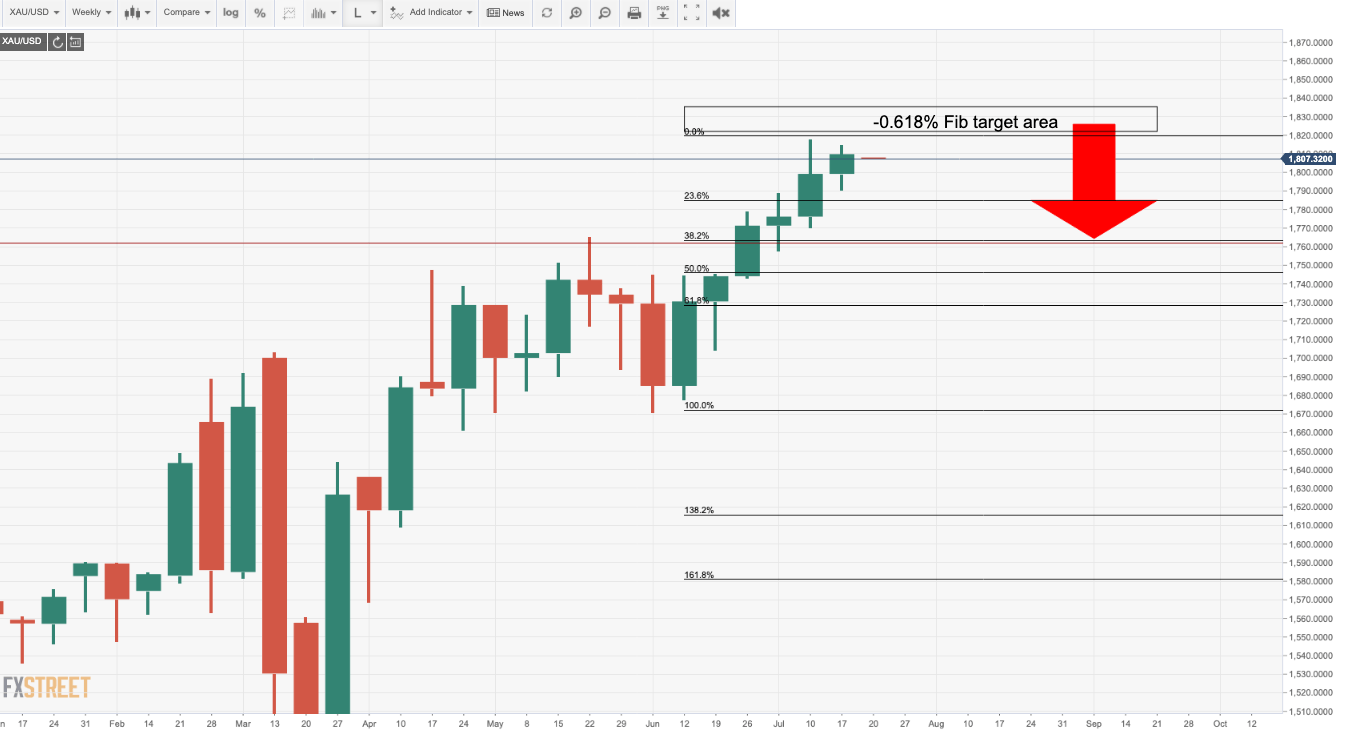

Moving down to the weekly chart, we can see that bulls are on track for the 1825 area, which is the -0.618% Fibonacci extension level.

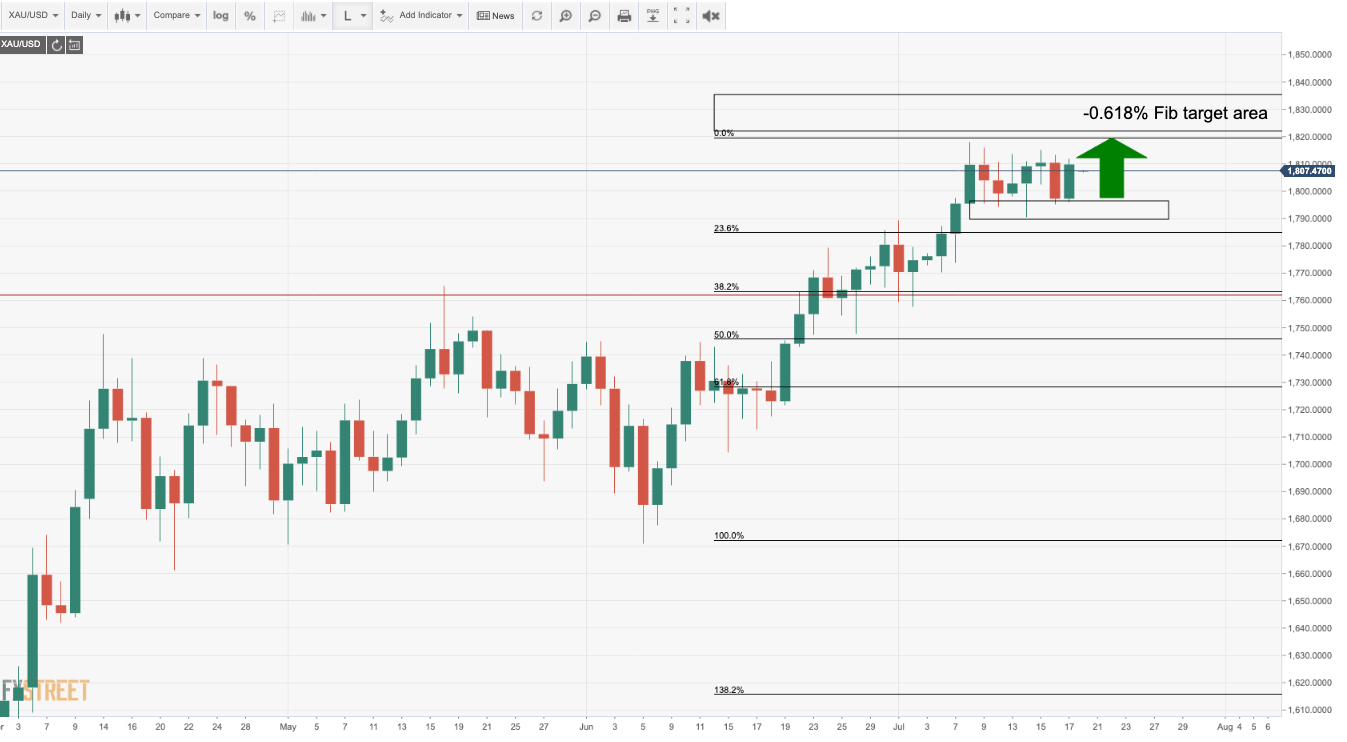

On the daily time frame, the bulls are digging in their hooves on firm ground which guards a critical support structure.

The prior resistance is acting as new support.

A break here to the downside opens the risk of a retest of the prior support structure turning resistance for sellers to emerge and a new phase of potentially prolonged distribution.

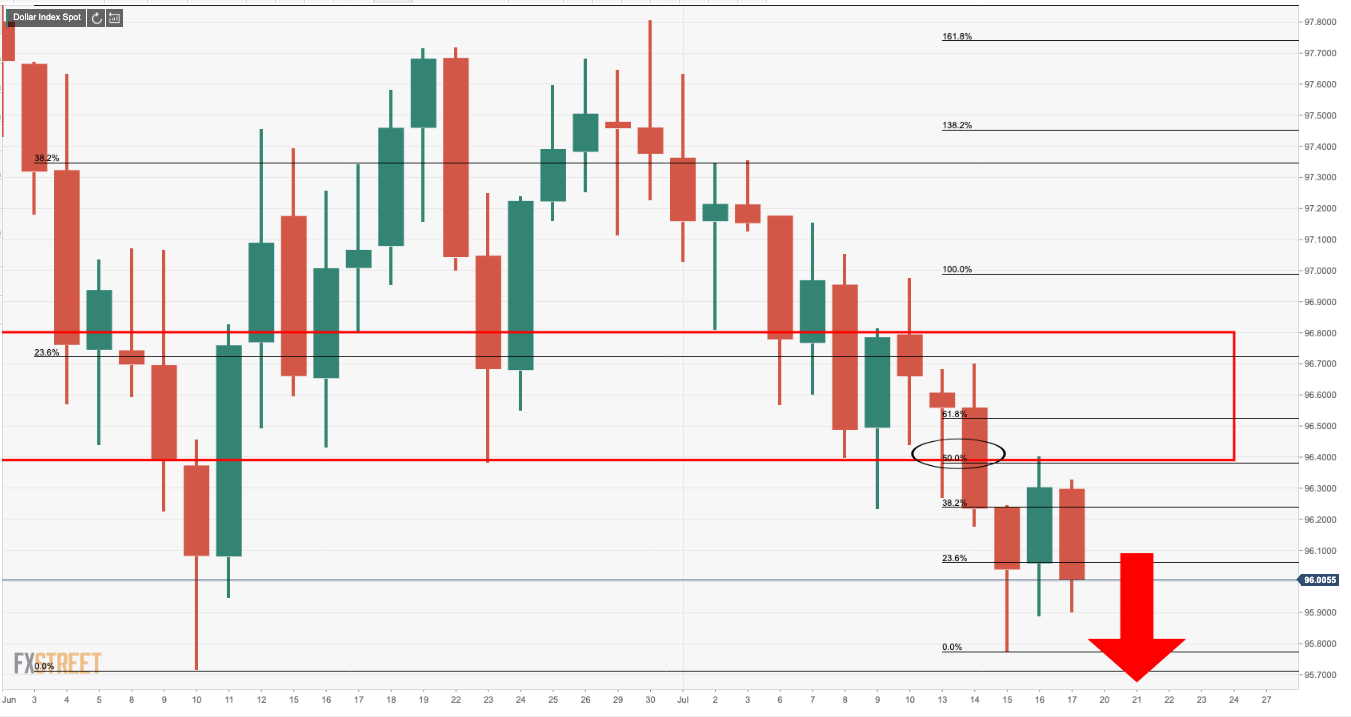

The USD saw broad-based selling. News of potential vaccine breakthroughs led to the improvement in risk appetite, edging the DXY lower from a 50% mean reversion of the latest bearish daily impulse.

But, analysts at TD securities pointed out that speculative positioning in gold, while not extreme, has begun to bloat, “which increases the risk of potential short-term shakeouts of positioning, should the macro outlook begin to change.”