- The risk-off mood, a modest USD pullback assisted gold to recover its intraday losses.

- The near-term technical set-up still seems tilted firmly in favour of bearish traders.

- Any positive move might be seen as a selling opportunity near the $1855 region.

Gold recovered a major part of its intraday losses and has now moved to the top end of its daily trading range, around the $1843-44 region.

The prevalent risk-off mood extended some support to the safe-haven precious metal and helped limit the early slide. This, along with a modest US dollar pullback from highs, provided a modest lift to the dollar-denominated commodity.

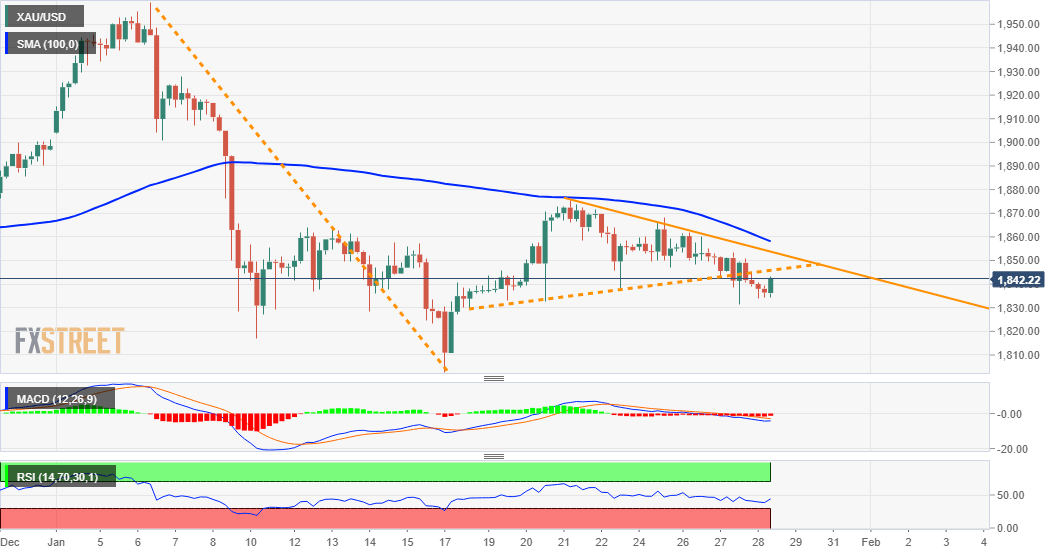

Looking at the technical picture, the commodity on Wednesday decisively breakthrough short-term symmetrical triangle support. Given the recent fall, the mentioned triangle constituted the formation of a bearish pennant chart pattern.

The bearish breakdown was further reinforced by the fact that technical indicators on the daily chart have just started drifting into the negative territory. Hence, any attempted recovery move might be seen as a selling opportunity.

The XAU/USD seems vulnerable to slide below the $1827-26 intermediate horizontal support and aim back to test monthly swing lows, around the $1800 mark. Some follow-through selling should pave the way for additional near-term weakness.

On the flip side, 50-day SMA, around the $1855 region, now seems to act as an immediate strong resistance. This coincides with the symmetrical triangle resistance, which if cleared will negate any near-term bearish bias.

XAU/USD 4-hourly chart

Technicallevels to watch