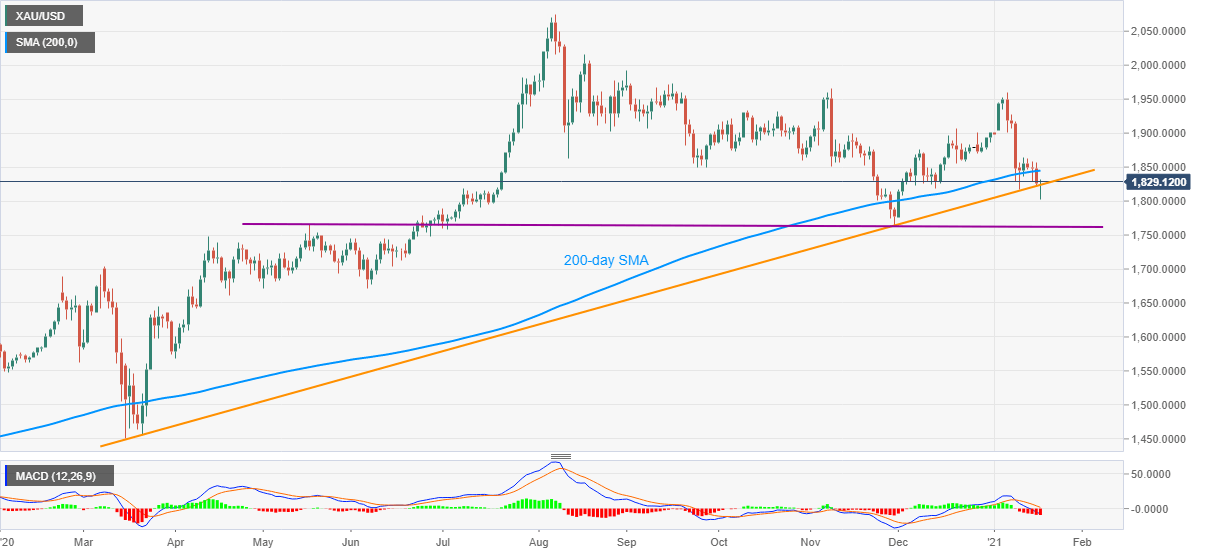

- Gold refreshes intraday high after taking a U-turn from the lowest since December 01, 2020.

- Failures to break medium-term support line directs buyers towards 200-day SMA.

- Bearish MACD favor gold sellers, last week’s top add to the upside barriers.

Gold takes the bids near $1,832, up 0.29% intraday, during early Monday. The yellow metal refreshed a multi-day low before bouncing off $1,802.80 but the corrective recovery needs to cross 200-day SMA to convince the buyers.

As a result, the current run-up eyes 200-day SMA level near $1,845 whereas the previous week’s top surrounding $1,865 will act as an extra upside barrier.

Although bearish MACD defies any further upside, a clear run-up past-$1,865 will eye the $1,900 threshold.

Meanwhile, an upward sloping trend line from March 2020, currently around $1,823, teases the gold sellers as a daily closing beneath the same will challenge the November 2020 low of $1,764.60.

In doing so, the $1,800 round-figure may offer an intermediate halt to the gold bears while April 2020 top near $1,748 can lure the downside moves afterward.

Overall, gold prices are likely to remain depressed unless marking a notable strength above 200-day SMA.

Gold daily chart

Trend: Bearish