- Gold prices pick-up bids to refresh intraday top.

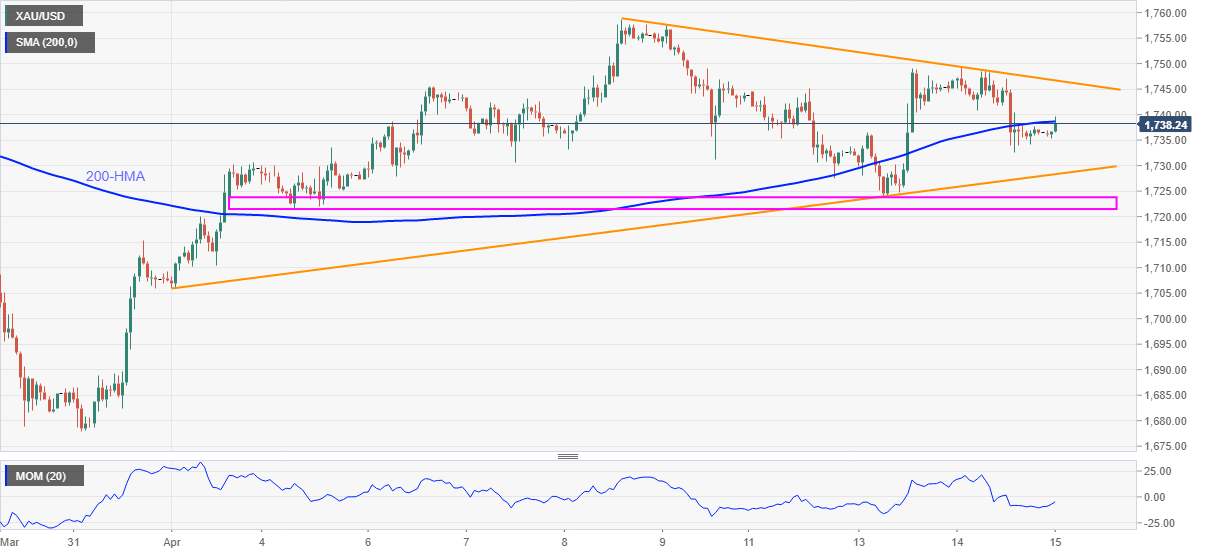

- Sustained bounce-off monthly horizontal support keeps buyers hopeful inside short-term symmetrical triangle.

- Monthly bottom adds to the downside filters, November 2020 low offers extra challenge to the bulls.

Gold refreshes intraday high to $1,739.58, up 0.15% intraday, during Thursday’s Asian session. In doing so, the yellow metal confronts 200-HMA while staying inside the monthly symmetrical triangle formation.

Although the commodity’s ability to stay above a horizontal area establishes since April 01 favors the buyers, sluggish Momentum and the key HMA tests the gold bulls near $1,747, comprising the upper line of the stated triangle.

Even if the precious metal manages to cross the $1,747 hurdle, the monthly high around $1,760 and November 2020 bottom surrounding $1,765 act as extra upside challenges to the bullion.

On the flip side, a downside break of the triangle’s support line, around $1,728, will drag the quote to the stated horizontal support area between $1,721 and $1,724, a break of which will highlight the monthly low of $1,705.91 for sellers.

Should there be an increased downside past-$1,705.91, the $1,700 threshold and the previous month’s bottom close to $1,676 will be the key to watch.

Gold hourly chart

Trend: Pullback expected