Gold prices ease after refreshing the nine-day high earlier in Asia, currently around $1,842 ahead of Friday’s European session. The broad US dollar strength and risk-on mood favored the yellow metal buyers before the recent consolidation of the US dollar index (DXY), near the lowest level since April 2018, joins a lack of market-moving catalysts.

Chatters concerning the vaccine suggest the world will soon have the cure to the pandemic, with Moderna and Pfizer gaining major attention after the UK approved the latter one. Though, the US restriction on the visit limit of Chinese Communist Party members and their families and a ban on Xinjiang cotton imports, coupled with blacklisting four companies citing military ties, probed the risk-on mood.

Against this backdrop, S&P 500 Futures seesaw around the multi-year high, flashed on Thursday, with mild gains whereas stocks in Asia-Pacific trade mixed by press time.

Gold traders await further weakening of the US dollar, likely taking clues from November’s Nonfarm Payrolls (NFP) and Unemployment Rate data, for further upside.

Read: Nonfarm Payrolls Preview: Another dollar’s disappointment underway

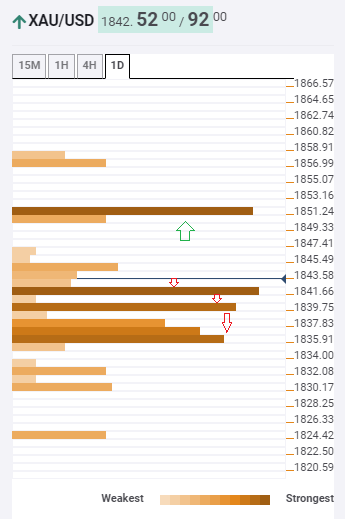

Gold: Key levels to watch

Having successfully cleared $1,841 confluence, comprising the Fibonacci 38.2% one-month and the Simple Moving Average 5-15m, gold buyers are well set to challenge the middle Bollinger on the daily chart and Pivot Point one-week Resistance 1 around $1,851.

Other than the key levels suggested by the Technical Confluences Indicator, the early November low also highlights $1,851 as the key upside hurdle.

Should the metal crosses $1,851, Pivot Point one-week Resistance 1 around $1,857 can offer an intermediate halt before October’s low near $1,860.

Meanwhile, a downside break below $1,841 doesn’t recall the gold bears as the previous low on the four-hour chart (4H), middle Bollinger on the hourly play and SMA 5 on 4H challenge limit the quote’s further downside around $1,839.

Additionally, a downside break of $1,839 may catch a breather around 38.2% Fibonacci retracement of one-day, close to $1,835, before welcoming the gold sellers.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence