- Gold under pressure as market recalculates their outlook for QE expectations.

- Fed mentioned tapering QE after “substantial progress”.

Gold prices have dropped a fraction on the back of last Federal Open Market Committee’s meeting for 2020 that started yesterday, concluding with the Federal Reserve’s interest rate decision, monetary policy announcements and statement.

It has been a slightly less dovish outcome, propelling the dollar a little higher and weighing on gold prices. The Fed has already mentioned tapering QE after “substantial progress”.

This will now be followed by the Fed’s Chair’s press conference.

Key takeaways, so far

- US Fede holds benchmark interest rate unchanged at 0% to 0.25%.

- Target range stands at 0.00% – 0.25% .

- The interest rate on excess reserves unchanged at 0.10%.

- Dot plot at end of 2023 remains at zero.

- Will continue pace of bond buys until ‘substantial’ progress on goals.

- Will continue to buy $80b/month in treasuries and $40b/month in MBS.

- Will continue bond buys “until substantial further progress has been made toward the committee’s maximum employment and price stability goals.”

- Repeats that “the ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term”.

- Fed sees US GDP down 2.4% in 2020, up 4.2% in 2021 and up 3.2% in 2022.

- Fed sees unemployment rate at 6.7% in 2020, 5% in 2021 and 4.2% in 2022.

All in all, this is slightly less dovish than expected.

The fact that the Fed has already mentioned tapering the QE is an unexpected outcome which has the market recalculating inflation expectations and real rate scenarios which have been a major contributor to gold’s rally this year.

The presser will be revealing a potential minefield for gold traders as Fed’s Chair Powell will be questioned on the above.

Additional forward guidance linking QE to economic outcomes along with an extension in the weighted average maturity of Treasury purchases will be a hot topic for gold.

However, markets are already in anticipation of a fiscal deal and nominal yields may remain capped, keeping real rates reverting on a downward trajectory and weighing on the USD for the near and medium-term.

”Trend followers hold a substantial amount of dry-powder to add to their net length in gold down the road, with CTA trend followers now eying a break above the $1905/oz range to catalyze long accumulations,” analysts at TD Securities have argued.

”At the same time, the recent strength in the complex has sparked a buying program in industrial-precious metals silver and palladium. The magnitude of the expected trend follower flow should favour the latter.”

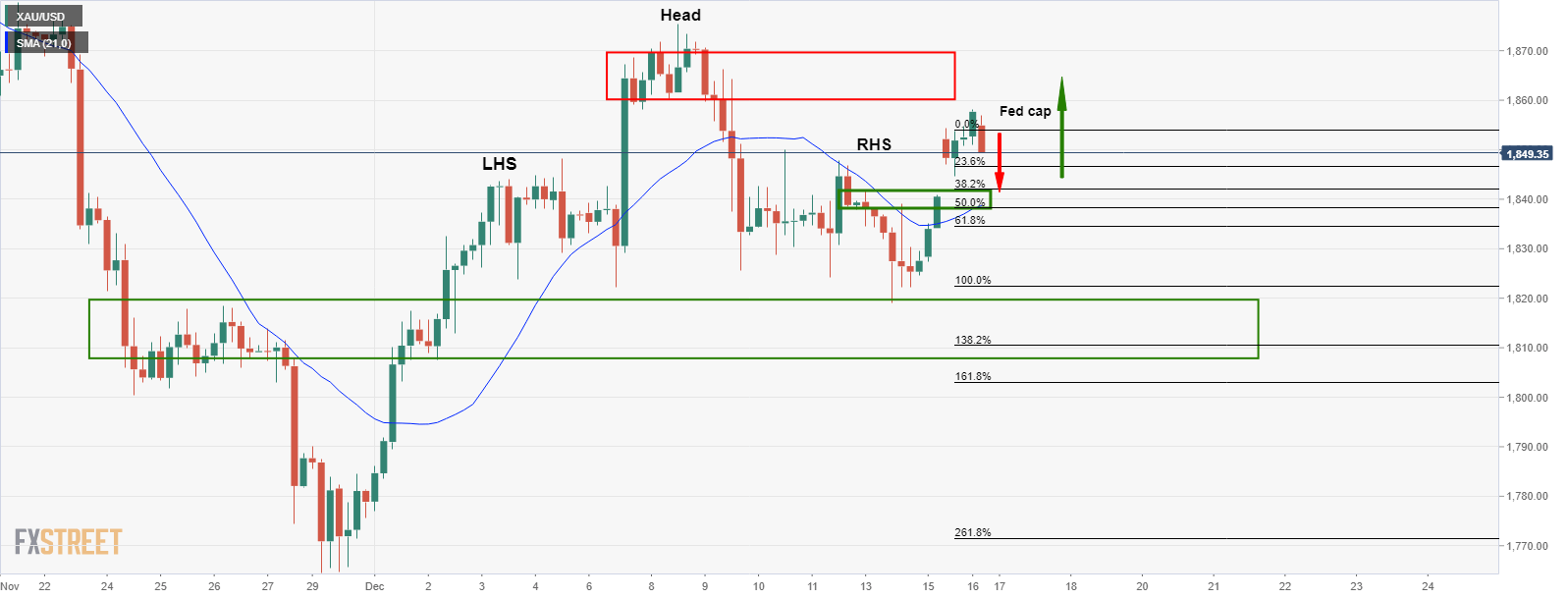

Gold technical analysis

Gold prices are yet to offer a significant Fibonacci retracement following the surge to the upside earlier in the week which negated the bearish head and shoulders on the 4-hour time frame.

Today’s less dovish FOMC outcome could be exactly what bulls looking for a discount could have hoped for: