- Gold is up more than 1% on Friday.

- XAU/USD broke above 200-day SMA and approaches $1,870 resistance.

- Key support in near-term is located around $1,850.

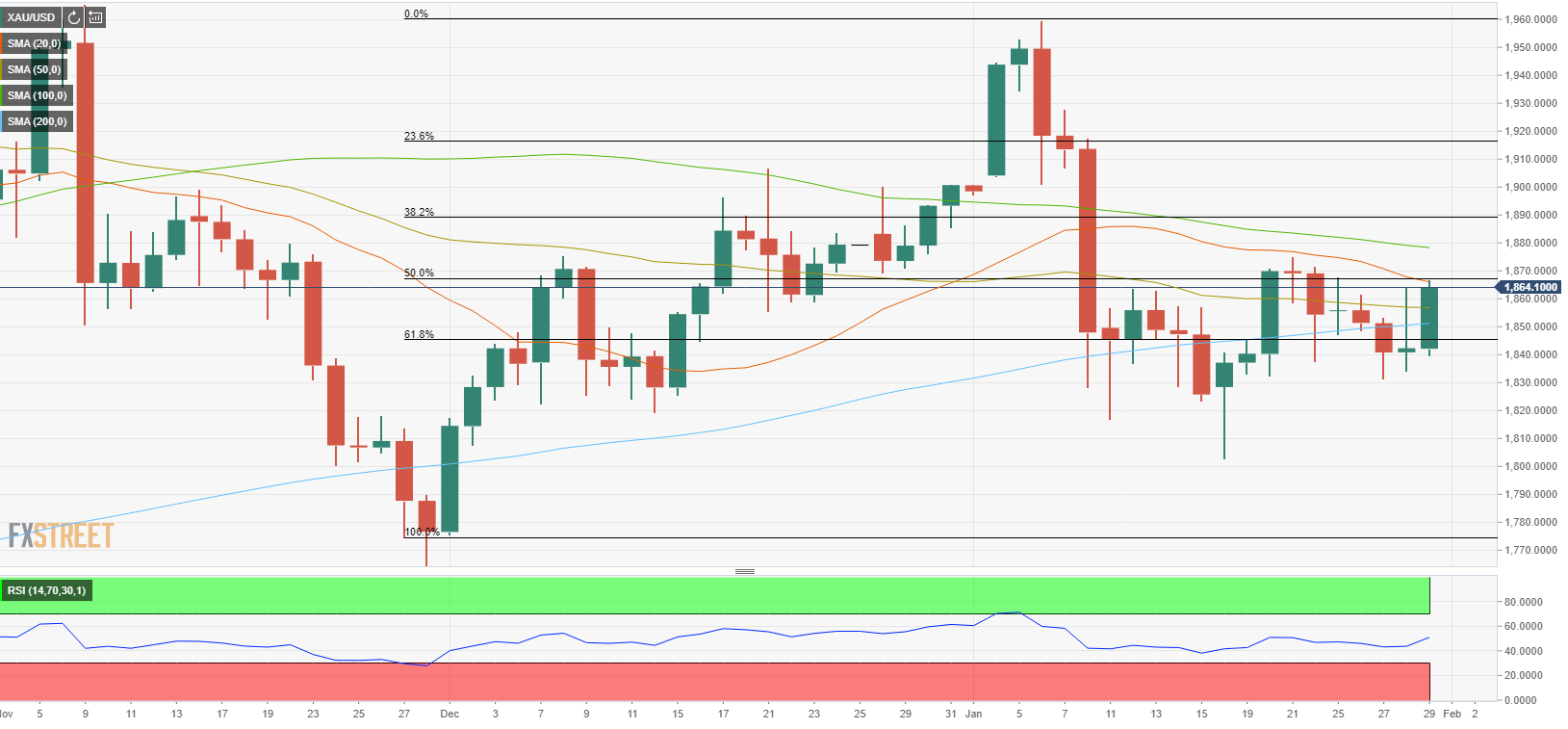

The XAU/USD pair failed to capitalize on the broad-based USD weakness on Thursday and erased a large portion of its daily gains before closing at $1,842. On Friday, gold gained traction and extended its rally with a decisive break above the 200-day SMA, which is currently located around $1,850. As of writing, XAU/USD was up 1.15% on the day at $1,864.

Gold technical outlook

The near-term outlook seems to have turned bullish with Friday’s upsurge. The Relative Strength Index (RSI) indicator on the daily chart turned north and rose above 50 for the first time in more than a week.

On the upside, the initial resistance aligns at $1,870, where the Fibonacci 50% retracement of the December uptrend and the 20-day SMA coincide. Above that level, the 100-day SMA could be seen as the next target at $1,880 ahead of $1,890 (Fibonacci 38.2% retracement).

Supports, on the other hand, are located at $1,851 (200-day SMA), $1,845 (Fibonacci 61.8% retracement) before $1,831 (Jan. 27 low).