- Gold has been dumped on Friday, with the spot price currently down over 4.0% or nearly $80.

- Triggering the losses has been a substantial rally in longer-dated US real bond yields.

- Some traders have attributed the move higher in yields to comments from the Vice Chairman of the Fed Richard Clarida.

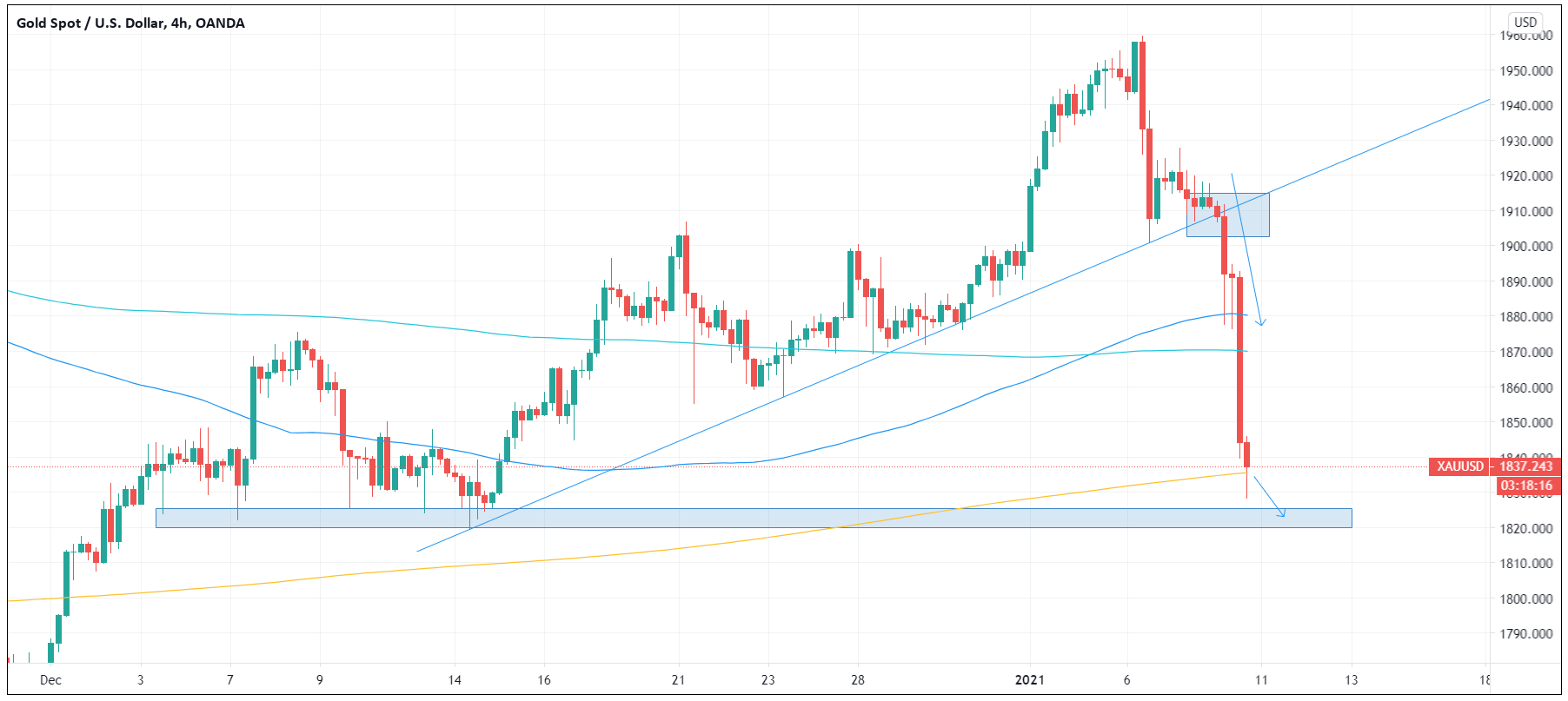

Spot gold (XAU/USD) has been dumped on the final trading day of the week, with the spot price currently down over 4.0% or nearly $80. XAU/USD currently trades in the $1830s, having slipped through its 21, 50 and 200-day moving averages at $1880.265, $1870.074 and $1835.587 respectively on the way down from Friday opening levels above $1900. The $1820-$1830 region should offer some support.

Other precious metals such as spot silver (down more than 9%), spot palladium (down nearly 3%) and spot platinum (down roughly 5%) have also been dumped.

Triggering the losses has been a substantial rally in longer-dated US real bond yields; the 10-year TIPS yield is up around 9bps to -0.96% having opened the session closer to -1.05% and the 30-year TIPS yield is up just over 8bps to just under -0.21% having opened closer to -0.3%.

Why are real yields are advancing?

Some traders have attributed the move higher in yields, which has also given the US dollar a helping hand (DXY is at highs of the day above 90.00, another negative for precious metals!), to comments from the Vice Chairman of the Fed Richard Clarida; while he said that he did not expect the Fed to reduce the pace of its asset purchase programme in 2021 (this has been a hot topic this week with many FOMC members speaking on the topic), he said that he was not concerned about the US 10-year yield rising above 1.0%, that yields are still very low and that there is no need to adjust the maturities of bond-buying.

Traders seem to have taken this as a “green light” for the rally in yields to resume. The biggest rally in US yields today has been in real yields (the moves noted above). Nominal yields are also higher (10-year +3.4bps and 30-year +2.4bps), but the fact that nominal yields have not rallied as much as real yields mean that inflation break-evens (the difference between nominal and real yields) has narrowed, another negative for precious metals (remember, precious metals are seen as an inflation hedge).

Whilst comments from Clarida might have accelerated the rally in real yields (and accelerated the decline in precious metals), the main factor behind the rally is expectations that the US government will be issuing substantially more debt in 2021 now that the Democrats have taken control of Congress. A higher supply of debt combined with a Fed that is seemingly ok with higher yields (it can usually be assumed that comments from Vice Chairman Clarida are in line with Fed consensus thinking given his importance at the bank) is a cocktail for higher real yields.

XAU/USD four hour chart