Gold has been shooting higher after the Federal Reserve opened the door to more money-printing – even if not at the current juncture. Moreover, US fiscal stimulus talks are progressing with growing chances that an accord is struck within hours.

The prospects of more funds flowing from Washington have boosted the precious metal. How is XAU/USD positioned on the charts?

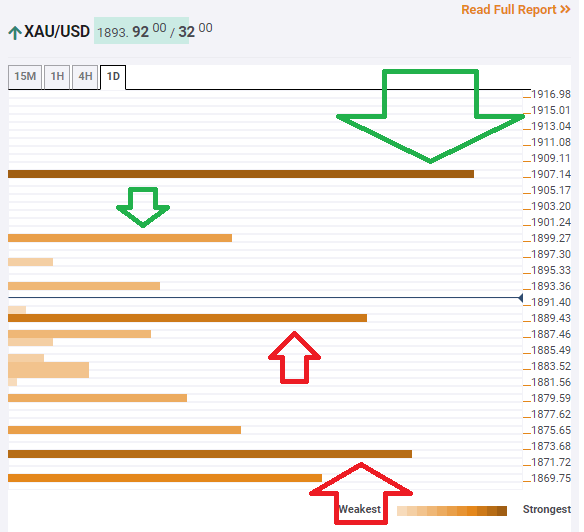

The Technical Confluences Indicator is showing that gold has faced soft resistance at $1,899, which is where the Pivot Point one-week Resistance 2 meets the previous 1h-high.

A strong cap awaits at $1,907, which is a juncture including the 100-day Simple Moving Average and the PP one-month R1.

Looking down, support is at $1,889, which is the confluence of the Fibonacci 61.8% one-month and the Bollinger Band 1h-Upper.

Further below, the next cushion is at $1,872, which is a cluster including the BB 1h-Middle, the PP one-day R1, and the 50-day SMA.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence