As the US Congress leaders make progress on talks over a $1 trillion covid aid package, markets eye an imminent stimulus deal, knocking off the US dollar further south. Expectations of additional funds are boosting the inflation-hedge Gold (XAU/USD), as it extends its break above the $1850 level.

The coronavirus vaccine optimism also collaborates with the dollar’s weakness, offering extra zest to the XAU bulls. However, it remains to be seen if the metal extends the upside heading into the FOMC showdown. Let’s take a look at how is gold positioned on the charts?

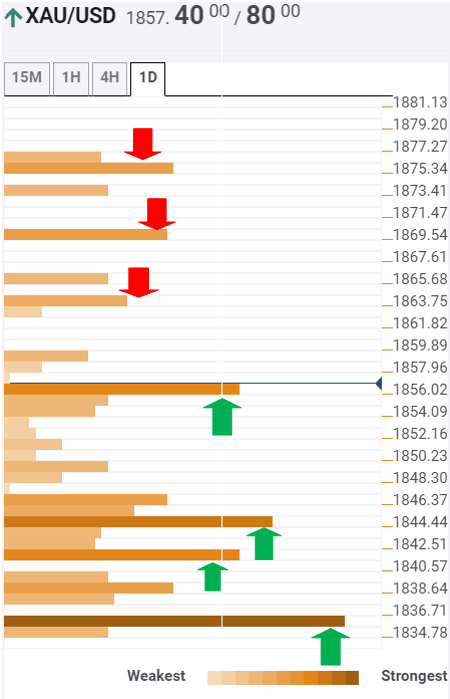

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that the XAU/USD pair is looking to extend Tuesday’s rally towards the $1863 upside target, which is the Fibonacci 23.6% one-week.

On a break above the latter, the bulls are likely to challenge a strong cap at $1870, the Pivot Point one-week R1.

Acceptance above that level could prompt a fresh advance towards the $1876 barrier, which is the convergence of the previous week high and Pivot Point one-day R2.

On a break above the latter, the bulls could challenge the $1840 level, which is the confluence of the Pivot Point one-day R1 and SMA10 one-day.

Alternatively, if the bulls fail to defend immediate support at $1856, the previous day high, the price could be poised for a gradual decline amid several minor support levels stacked up to the downside.

The critical support at $1844 is expected to be a tough nut to crack for the bears.

The Fibonacci 38.2% one-month at $1841 could also offer some support before the price hits the concrete cushion at $1836, the Pivot Point one-day S1.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence