- Gold probes intraday high, snaps two day downtrend.

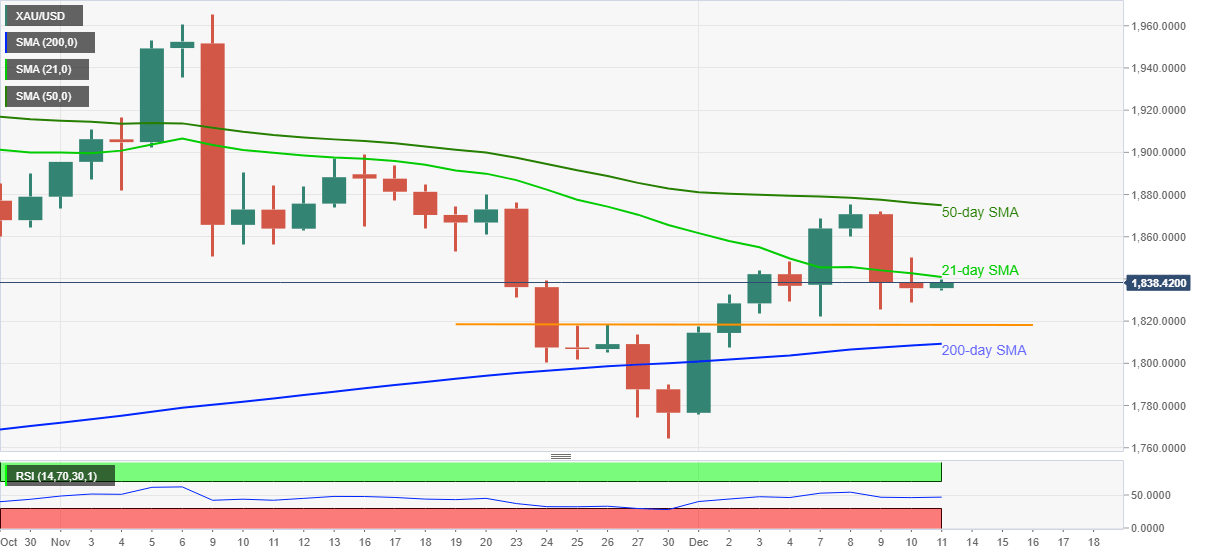

- Sustained trading below 50-day, 21-day SMAs, challenge buyers amid normal RSI conditions.

- Two-week-old horizontal support, 200-day SMA on the bears’ radars.

Gold rises to $1,838.60, up 0.15% intraday, during early Friday. The yellow metal recently refreshed the day’s high to $1,839.55, which in turn allowed it to defy the previous two days’ downside momentum.

However, 21-day SMA, currently around $1,841, guards the immediate upside amid normal RSI conditions.

Even if the gold buyers manage to cross $1,841, 50-day SMA near $1,875 and the mid-November top near $1,900 will test the metal’s upside momentum.

Meanwhile, a sustained trading below the key short-term SMAs directs the quote towards lows marked during late November, around $1,818/17.

In a case where the gold sellers dominate past-$1,817, the 200-day SMA level of $1,809 and the $1,800 round-figure will provide strong support to prices.

Gold daily chart

Trend: Pullback expected