- Gold looks to extend the recovery momentum beyond 200-HMA.

- Bull flag breakout on the 1H chart suggests more gains ahead.

- Overbought RSI conditions remain a cause for concern for XAU bulls.

Gold (XAU/USD) is holding the higher ground above the $1700 level, as the recovery from multi-week lows extends into the second day on Thursday.

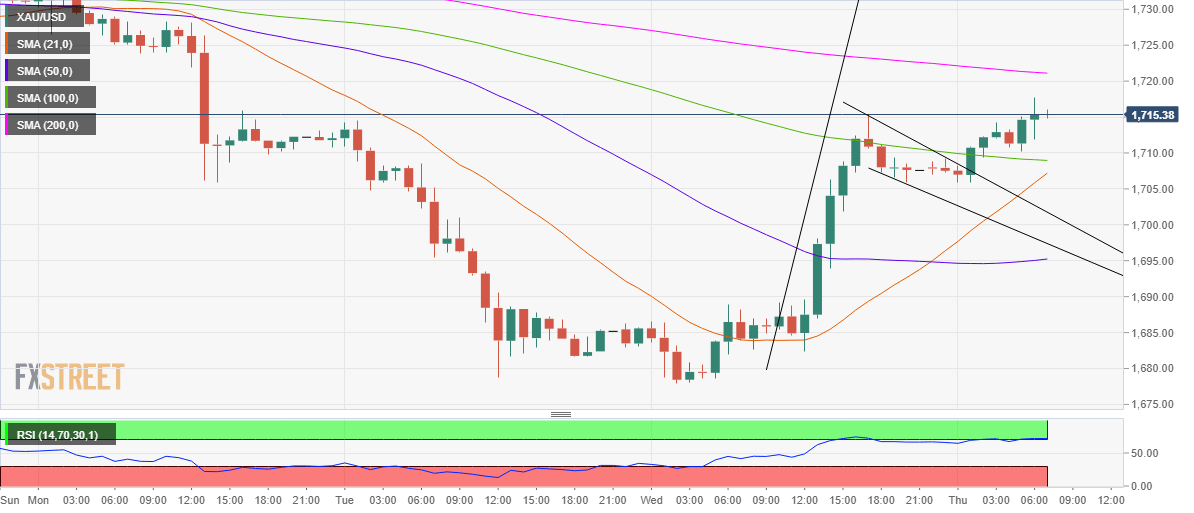

Adding credence to the ongoing upbeat momentum, a bull flag breakout got confirmed on the hourly chart earlier in the Asian session.

Gold Price Chart: One-hour

The upside break prompted the XAU bulls to regain a strong foothold above the downward-sloping 100-hourly moving average (HMA) at $1709.

The next critical barrier for the buyers awaits at $1721, which is the horizontal 200-HMA. Only a sustained move above the latter could unleash additional recovery gains.

The Relative Strength Index (RSI) lies in the overbought territory, as of writing, suggesting weakening upside momentum.

Therefore, gold could likely face rejection at the above-mentioned 200-HMA, with the focus back on the 100-HMA resistance now support.

A break below that cushion, the upward-sloping 21-HMA at $1707 could be challenged.

The $1700 mark could offer the last line of defense for the XAU bulls.

Gold: Additional levels