- Gold lost its traction after staging a robust recovery.

- Significant resistance seems to have formed around $1,760.

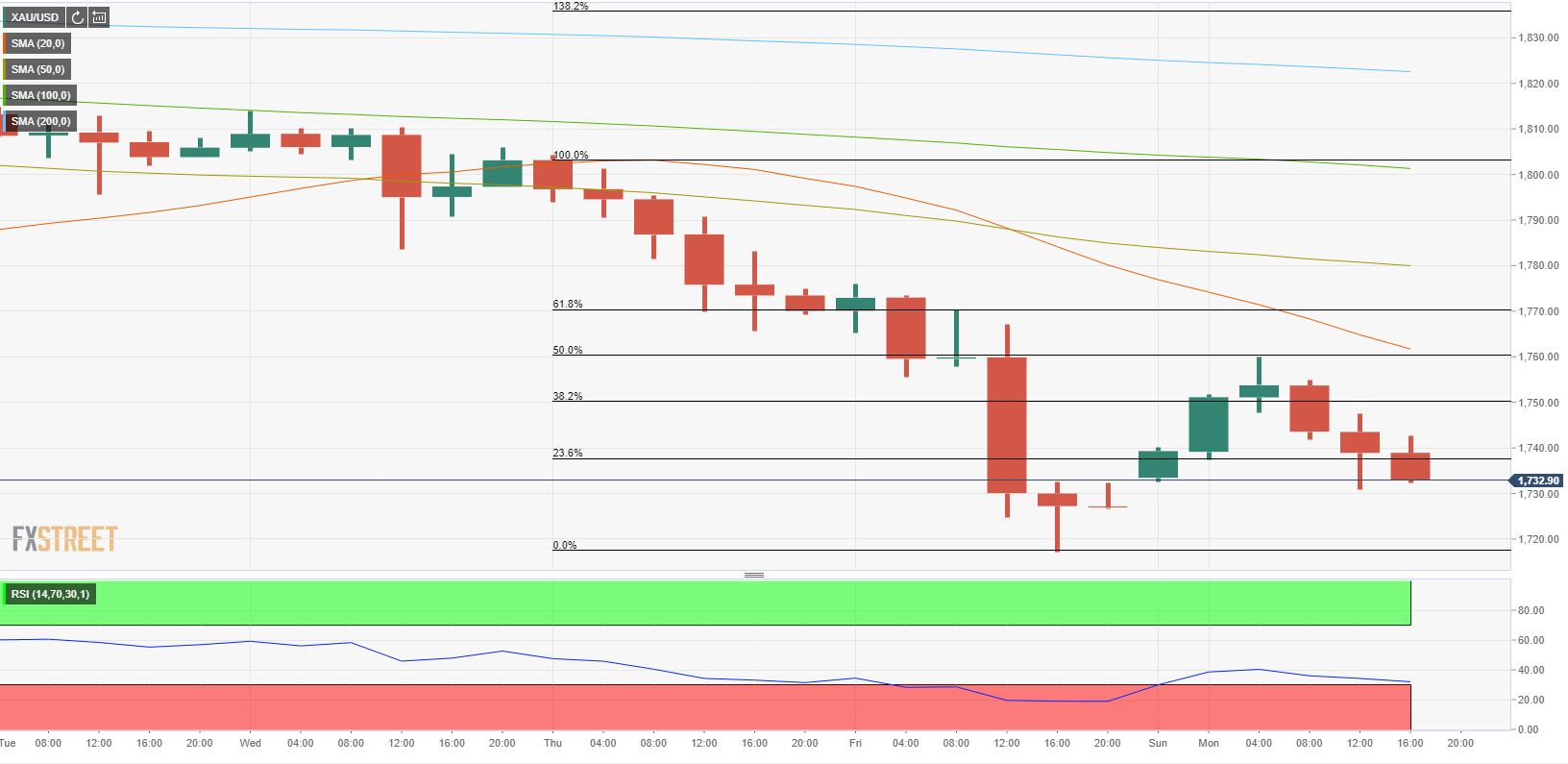

- RSI on H4 stays within a touching distance of oversold territory.

The XAU/USD pair started the new week on a firm footing and staged a strong rebound during the first half of the day. However, the pair struggled to preserve its bullish momentum into the American session and erased a large portion of its daily gains. As of writing, XAU/USD was posting small daily losses at $1,733.

Gold technical outlook

On the four-hour chart, gold seems to have reversed its course near $1,760, where the Fibonacci 50% retracement of the Thursday-Friday slump is located. Currently, the price is staying below the Fibonacci 23.6% retracement at $1,738 and the next target could be seen at$1,727 (Friday’s closing level) and $1,717 (multi-month low).

However, the Relative Strength Index (RSI) indicator on the same chart is staying within a touching distance of 30, suggesting that sellers could opt out to wait for another correction before the next leg down.

On the upside, $1,760 aligns as the next important hurdle ahead of $1,770 (Fibonacci 61.8% retracement) and $1,780 (50-SMA).

Additional levels to watch for