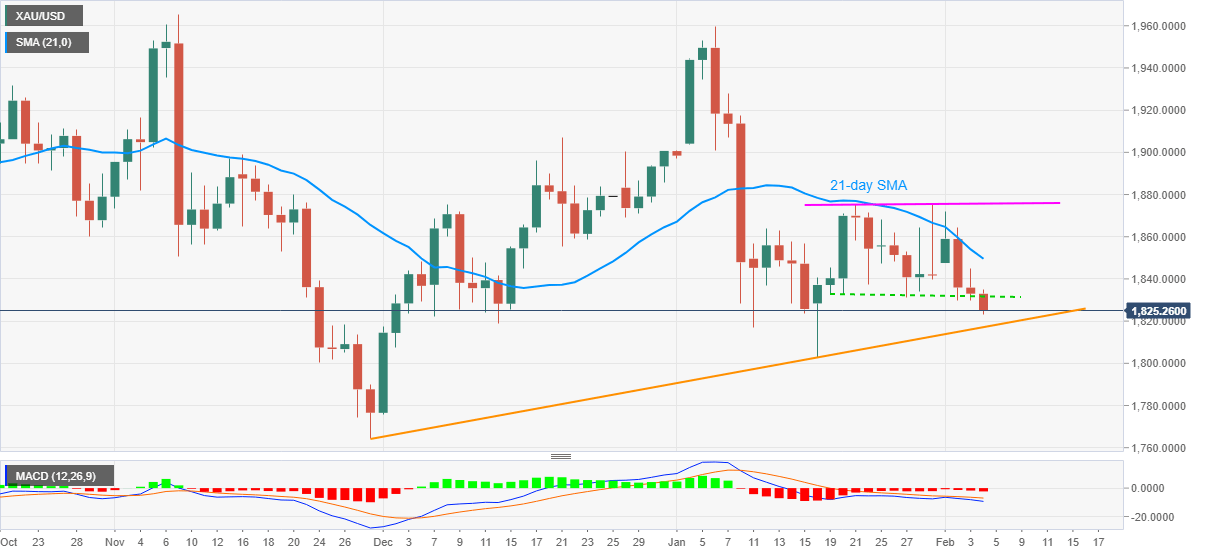

- Gold stands on slippery ground, drops for the third day.

- Bearish MACD, sustained weakness below 21-day SMA direct sellers to an ascending trend line from November 30.

- January’s “double top” formation adds to the upside filters.

Gold takes offers around $1,823.70, down 0.50% intraday, while extending downside momentum during early Thursday. The yellow metal has been declining following its early week failures to cross the 21-day SMA.

Also favoring the bullion sellers could be January’s “double top” confirmation, with a downside break of $1,830, as well as bearish MACD.

That said, the gold prices are en route to a three-month-long support line, at $1,817 now, ahead of teasing the $1,800 round-figure.

Though, any further weakness past-$1,800 psychological magnet will not hesitate to challenge November’s bottom surrounding $1,765.

During the quote’s bounce beyond $1,830, a 21-day SMA level of $1,850 and the late January’s highs near $1,875/76, will be the key to watch.

Overall, gold is up for a fresh lag to the south but a short-term support line can offer a bumpy ride.

Gold daily chart

Trend: Further weakness expected