- Gold struggled for a firm direction and remained confined in a range on Wednesday.

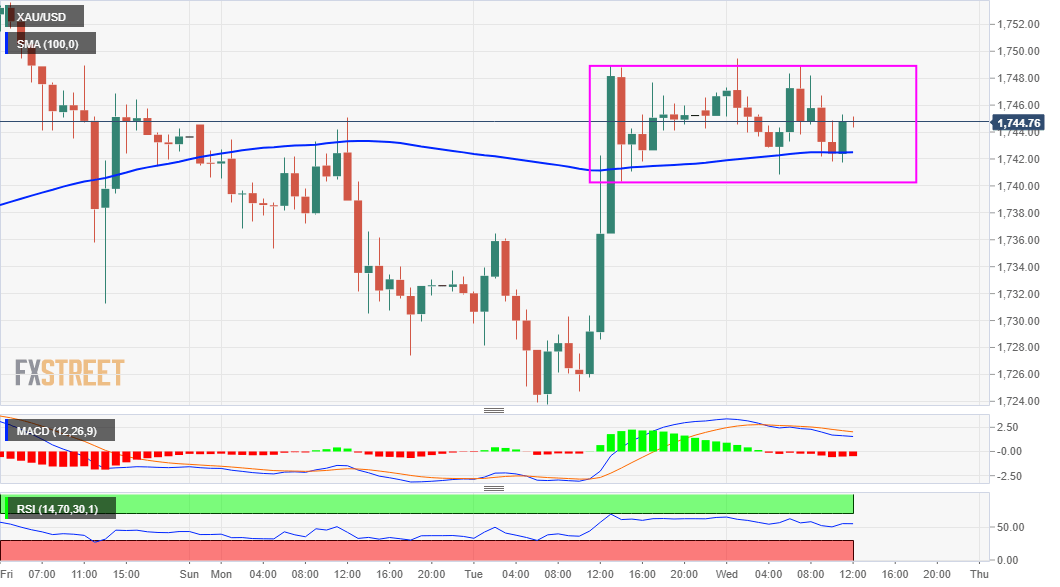

- The subdued price action constitutes the formation of a rectangle on the 1-hour chart.

- A mixed technical set-up warrants some caution before placing fresh directional bets.

Gold extended its sideways consolidative price moves through the mid-European session and remained confined in a narrow trading band, around the $1,745 region.

A generally positive tone around the equity markets failed to assist the safe-haven XAU/USD to capitalize on the previous day’s goodish bounce from the $1,724 area, or over one-week lows. Apart from this, a modest uptick in the US Treasury bond yields further collaborated towards capping gains for the non-yielding yellow metal.

Meanwhile, the US dollar languished near three-week lows, which, in turn, extended some support to the dollar-denominated commodity and helped limit any meaningful slide. Investors also seemed reluctant to place aggressive bets, rather preferred to wait for fresh clues from the Fed Chair Jerome Powell’s scheduled speech later this Wednesday.

From a technical perspective, the rangebound price action constitutes the formation of a rectangle on 1-hour chart. This marks a brief consolidation before the next leg of a directional move. Bullish technical indicators on hourly/daily charts support prospects for an eventual break to the upside and a further near-term appreciating move.

Meanwhile, the XAU/USD, so far, has struggled to break through the $1,750 immediate resistance. This makes it prudent to wait for a sustained break in either direction before placing aggressive bets. A sustained move beyond the mentioned barrier should pave the way for a move towards a previous strong support breakpoint, around the $1,760-65 region.

On the flip side, immediate support is now pegged near the $1,740 area. This coincides with the lower boundary of the intraday trading range, which if broken decisively will negate any near-term positive bias and prompt some technical selling. The XAU/USD might then accelerate the slide back towards challenging the $1,720 support zone.

Some follow-through selling would expose the $1,700 mark, below which bears might aim back towards challenging the double-bottom support near the $1,677-76 region, or multi-month lows touched in March.

Technical levels to watch