- XAU/USD remains under modest bearish pressure on Monday.

- Gold’s near-term outlook stays neutral with a bearish bias.

- Next key support is located around $1,720 area.

The XAU/USD pair managed to post small gains last week but struggled to gather momentum on Monday with the risk-averse market environment providing a stronger boost to the greenback rather than gold. As of writing, the pair was down 0.6% on a daily basis at $1,735.

Gold technical outlook

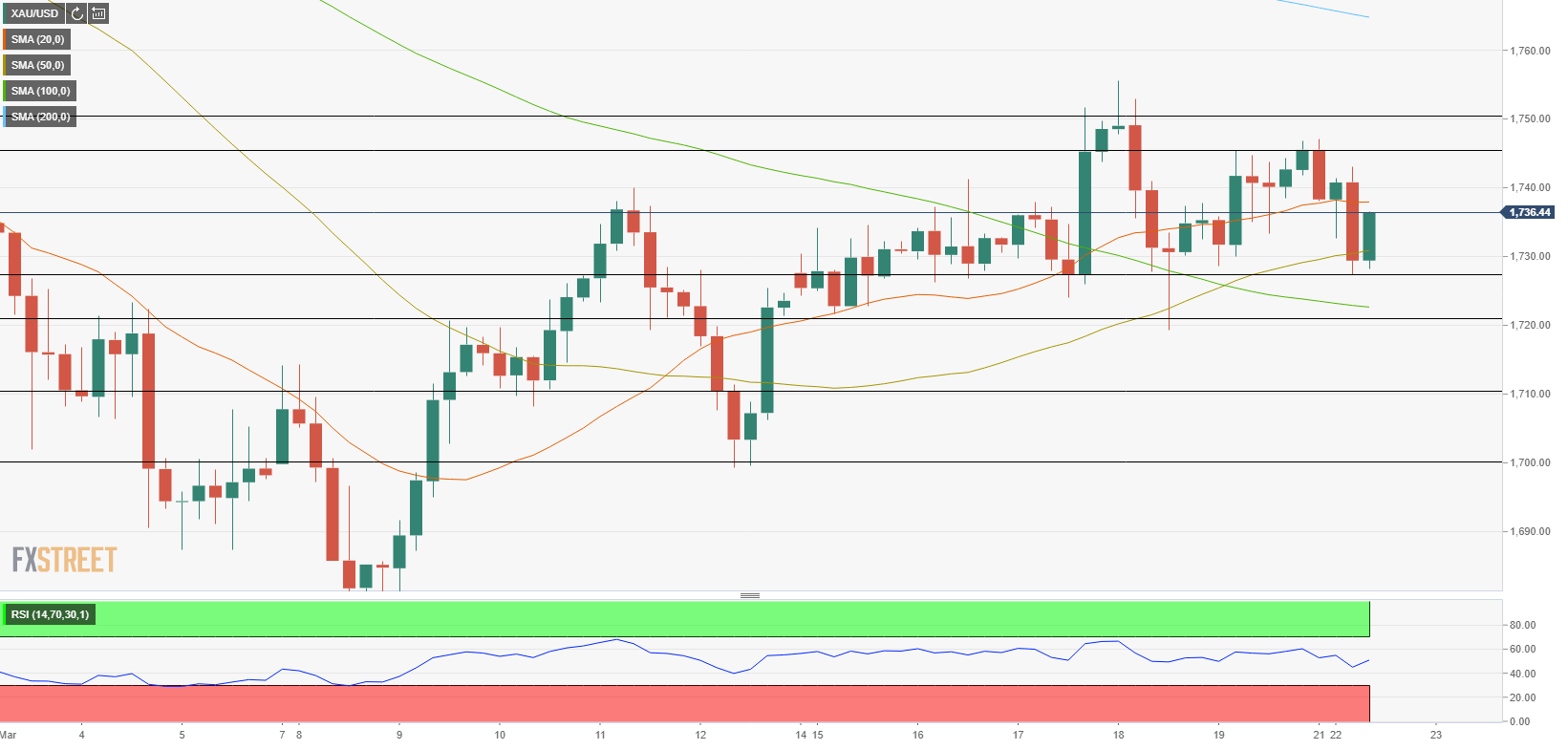

Earlier in the session, XAU/USD dropped to the lower limit of the near-term range around $1,730 but staged a technical rebound. On the four-hour chart, the 50-period SMA is enforcing this static support and a break below that level could open the door for additional losses toward $1,720 (100-period SMA, Fibonacci 23.6% retracement of the Feb. 2-Mar. 8 downtrend).

On the upside, the initial hurdle is located at $1,740 (20-period SMA) ahead of $1,750 (static resistance) and $1,755 (Mar. 19 high).

In the meantime, the Relative Strength Index (RSI) on the same chart is staying around 50, suggesting that gold is struggling to make a decisive move in either direction at the start of the week.

Additional levels to watch for

Additional levels to watch for

Additional levels to watch for

Additional levels to watch for