- Gold prices hold lower ground following fresh challenges to risks.

- Biden-Xi keep old terms during their first-ever telephonic talks.

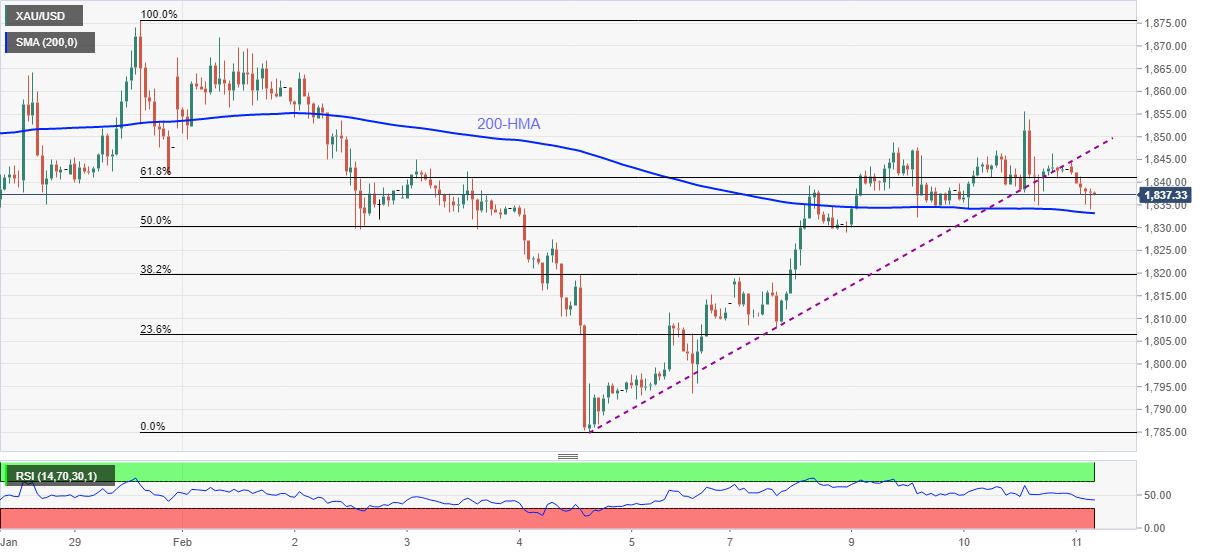

- Break of weekly support line, failures to stay above 61.8% Fibonacci retracement favor sellers.

Gold remains depressed around $1,837, down 0.30% intraday, during the early Thursday. The yellow metal recently refreshed the day’s low to $1,834.10 following the news concerning talks between US President Joe Biden and his Chinese counterpart Xi Jinping.

While US President Biden kept American dislike for Chinese policies, Beijing warned over Washington’s meddling in the Taiwan, Hong Kong and Xinjiang issues. Also challenging the risks could be Reuters’ report quoting a senior US official who hints at changes in policies relating to China.

Technically, the bullion’s failures to stay beyond 61.8% Fibonacci retracement of January 29 to February 04 downside, coupled with a break of a one-week-old support line, suggest the likely entry of bears.

However, a clear downside break of 200-HMA level around $1,833 becomes necessary for the gold sellers to target $1,818 and the $1,800 supports.

Meanwhile, an upside clearance of the latest top near $1,855 will eye for the late January high near $1,875 before directing gold buyers toward the $1,900 round-figure.

Gold hourly chart

Trend: Further weakness expected