Gold consolidates the heaviest losses in over a month around $1,795 during early Friday. The yellow metal dropped to a nine-week low the previous day before recovering from $1,785.

While the broad US dollar gains remain on the table, which has been weighing on gold prices off-late, the pre-NFP trading lull seems to challenge the commodity trading by press time. That said, the US dollar index (DXY) rises to a fresh high since December 01 while the market’s risk barometer in Asia, S&P 500 Future, also prints mild gains.

Moving on, the US Nonfarm Payrolls (NFP) and Unemployment Rate for January will be the key for the global markets amid hopes of recovery in the world’s largest economy.

Read: Nonfarm Payrolls Preview: Dollar needs a strong number to keep rallying

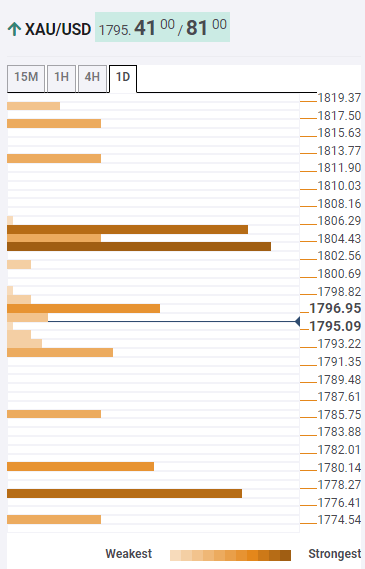

Gold: Key levels to watch

Despite the recent corrective pullback, gold remains below the key resistance area around $1,805, not to mention the adjacent hurdle near $1,797. As a result, sellers are well directed towards Pivot Point 1 support on the monthly chart, near $1,777.

However, the previous day’s low around $1,785 can offer an intermediate halt during the fall. Also filtering the moves could be the third support of pivot on weekly formation around $1,781.

Meanwhile, the previous high on 4H and 15-minutes join 23.6% Fibonacci retracement of the daily chart (1D) to guard immediate upside around $1,797.

Following that, the previous month’s low and SMA5 on 4H join 38.2% Fibonacci retracement level on 1D to highlight $1,804 as the resistance.

It should be noted that the pivot point support two on the weekly chart as well as SMA 100 on 15-minute play strengthens the resistance region around $1,805.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.