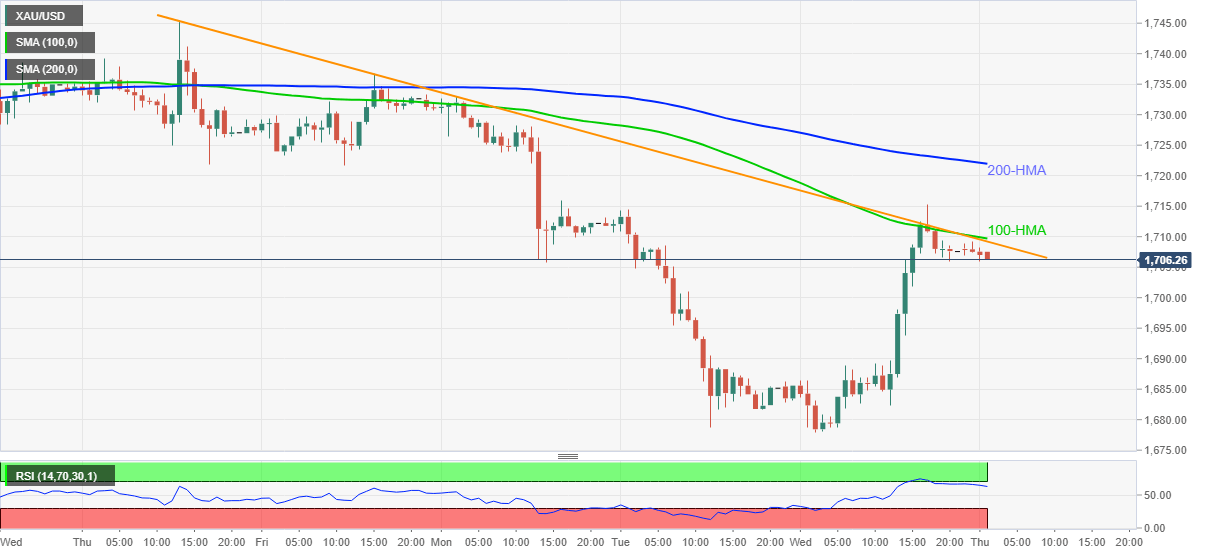

- Gold sellers attack intraday low while easing from short-term key hurdle.

- A convergence of 100-HMA, one-week-old resistance line guards immediate upside.

- 200-HMA also tests the bulls, $1,688 lures intraday sellers.

Gold prices drop to $1,706 during the latest pullback on early Thursday. The yellow metal’s failures to extend the previous day’s recovery moves beyond 100-HMA and a short-term resistance line joins recently weakening RSI, from an overbought area, to favor intraday sellers.

As a result, the bullion’s drop to the $1,700 threshold becomes imminent. However, any further downside will be challenged by $1,688.

Even if the quote manages to break the $1,688 support levels, the previous month’s low around $1,676 and bottoms marked during May-June 2020 near $1,670 will try to disappoint gold bears.

Meanwhile, an upside clearance of $1,710 needs to cross the 200-HMA level of $1,722 before recalling the short-term gold buyers.

Following that, late March’s swing high near $1,756 and November 2020 low around $1,765 will be crucial to watch.

Gold hourly chart

Trend: Further weakness expected