Gold bulls are offered temporary reprieve amid the US data disappointment, which reignited economic growth concerns and downed the US dollar. Markets have begun to respond to the fundamentals amid coronavirus vaccine hopes and surging infections worldwide.

Looking ahead, the recovery attempts in gold are likely to remain shallow amid Thanksgiving Day light trading. The metal remains on slippery grounds, with $1800 still at risk amid a lack of healthy support levels, as suggested by the technical charts.

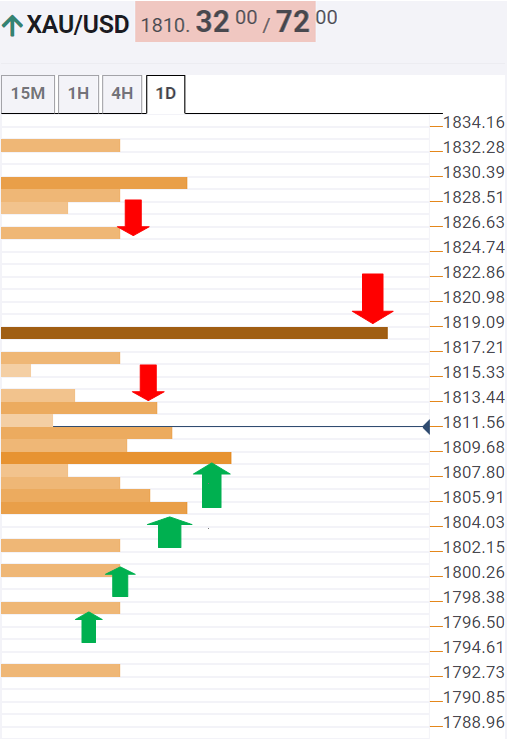

Gold: Key resistances and supports

The Technical Confluences Indicator shows that the XAU/USD pair faces immediate resistance at $1813 (previous high four-hour) as it attempts another bounce.

The next upside barrier awaits at $1816, which is the Pivot Point one-day R1.

The gold bulls need a sustained move above the powerful resistance at $1818, where the Pivot Point one-month S3 converges with the previous day high.

Buying interest will likely accelerate above the latter, opening doors for a test of the $1825 level, which is the Pivot Point one-day R2.

Alternatively, a failure to resist above $1808, the confluence of the Fibonacci 38.2% one-day and SMA10 four-hour, could expose the Pivot Point one-week S3 located at $1805.

Further south, the $1800 psychological support could be threatened, paving the way for a test of the fierce SMA200 one-day support at $1798.

The sellers would then target the $1793 cushion, which is the Pivot Point one-day S2.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence