Gold (XAU/USD) wavers within familiar ranges above the $1800 level, mainly supported by broad-based US dollar weakness, in response to the coronavirus vaccine-driven global optimism. The US FDA gave a green light to Pfizer’s vaccine early Thursday, with authorization expected within days.

Weak US jobs data also added to the downward pressure on the greenback, keeping a floor under the yellow metal. However, gold’s upside appears elusive amid the US fiscal stimulus stalemate and ongoing ETF outflows.

Meanwhile, the XAU sellers continue to lurk at the long-held support now resistance at $1850. Let’s take a deeper look into the technical charts for key levels of note.

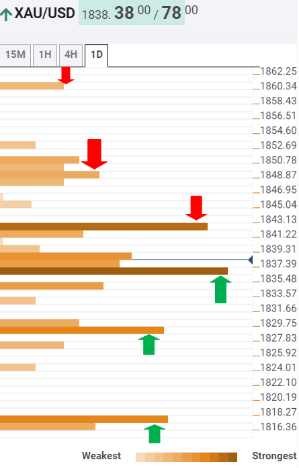

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that the XAU/USD pair is holding above strong support at $1836, which is the confluence of the previous low one-hour, SMA200 one-hour and SMA5 four-hour.

The next significant cushion awaits at $1828, the meeting point of the Fibonacci 23.6% one-week and the previous day low.

A breach of the last could trigger a sharp drop towards the $1818 support area, which is the Pivot Point one-day S2.

Alternatively, the gold buyers need to find a sustained break above the immediate barrier placed at $1842 to take on the upside once again. That level is the intersection of the Fibonacci 61.8% one-day and 38.2% one-month.

Further up, a dense cluster of healthy resistance levels is seen around $1850, which is the convergence of the previous week high, the previous day high, SMA5 one-day and SMA100 one-hour.

The Pivot Point one-day R2 at $1861 will then challenge the bulls’ commitment.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence