- The rebound was natural after its massive drop.

- XAU/USD could test and retest the resistance levels before going down.

- A new lower low activates more declines.

The gold price turned to the upside, trading at $1,964 at the time of writing. After its massive drop, a corrective downside was expected.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

The XAU/USD rebounded even though the US Unemployment Claims were reported at 242K, far below 253K expected and compared to 264K in the previous reporting period. In contrast, the Philly Fed Manufacturing Index was reported at -10.4 points versus -19.5 points estimated.

Furthermore, the Australian Unemployment Rate jumped from 3.5% to 3.7%, while Employment Change dropped unexpectedly from 61.1K to -4.3K, far below 24.8K forecasts.

Today, Canadian Retail Sales may report a 1.3% drop after the 0.2% drop in the previous reporting period, while Core Retail Sales could register a 0.8% drop.

In addition, the FOMC Member Williams and FOMC member Bowman’s speeches could also bring some action.

Still, the Fed Chair Powell Speaks represents the most important event. This could bring sharp movements in both directions.

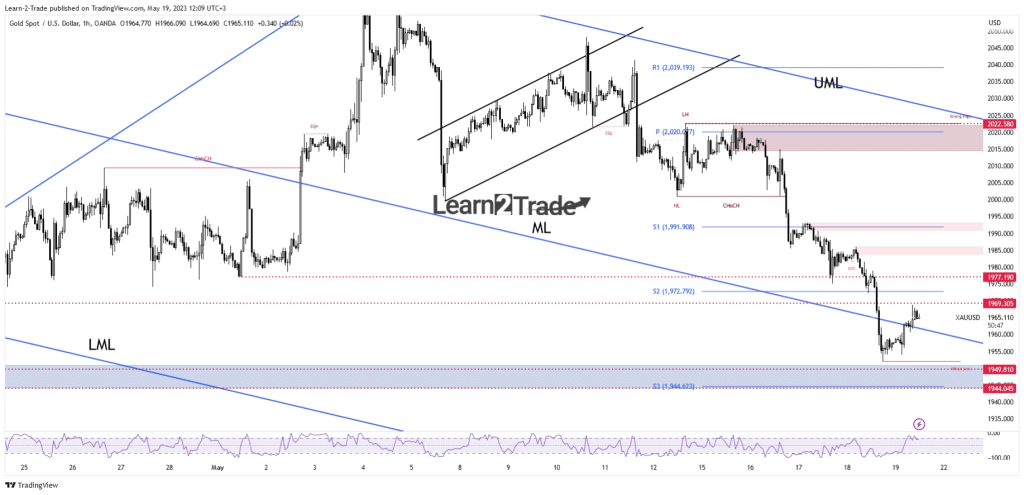

Gold price technical analysis: Upside corrective wave

From the technical point of view, after its massive drop, a rebound was highly probable. The metal has failed to hit the $1,949, $1,944, or the weekly S3 ($1,944) support level.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

We have a major demand zone above these support levels. Now, the gold price has turned upside and is above the median line (ML).

The $1,969 and $1,977 represent strong resistance levels. The rebound could be short-lived. XAU/USD could retest the immediate resistance levels before resuming the downside.

A larger rebound is far from being confirmed. Only a major reversal pattern should announce a strong leg higher. On the other hand, a new lower low activates more declines.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.