“¢ Surging US bond yields help ease USD bearish pressure and prompt some fresh selling.

“¢ Fading safe-haven demand, amid easing global trade tensions adds to the downward pressure.

“¢ Technical studies point to a possible resumption of the well-established bearish trend.

After an initial uptick to $1235 area, gold met with some fresh supply and has now eroded a part of gains recorded in the previous session.

Persistent US Dollar selling pressure, which tends to underpin demand for dollar-denominated commodities contributed to the initial uptick during the Asian session on Thursday. However, a goodish pickup in the US Treasury bond yields helped ease the USD bearish pressure and prompted some fresh selling around the non-yielding yellow metal.

This coupled with easing global trade tensions after the US President Donald Trump and European Commission President Jean-Claude Juncker agreed to work towards eliminating trade barriers, further weighed on the precious metal’s safe-haven appeal and collaborated to the ongoing retracement slide.

Technical Analysis

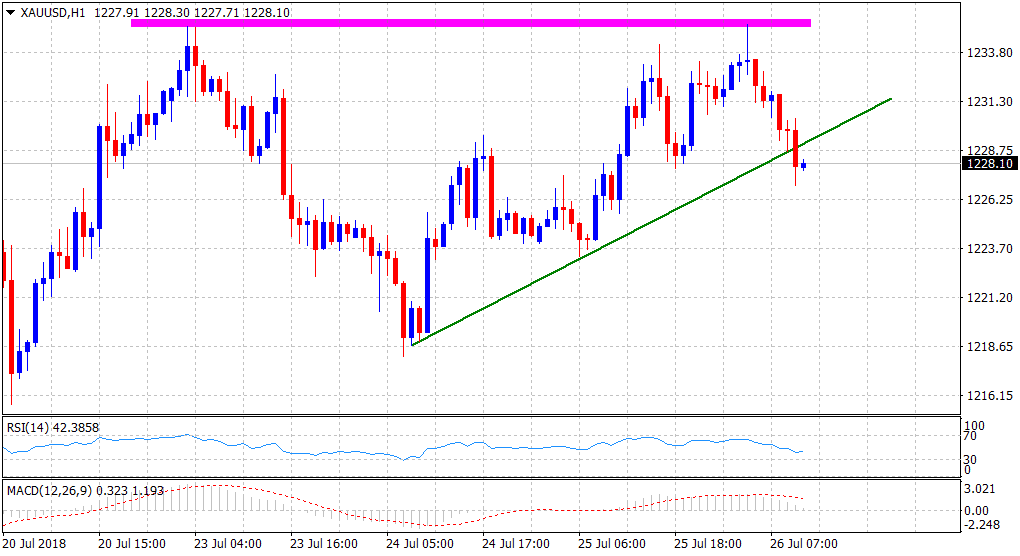

The commodity is retreating from weekly tops, set on Monday, which now seems to constitute towards forming a bearish double-top chart pattern on the 1-hourly chart.

Meanwhile, the latest leg of downfall over the past hour or so could also be attributed to some technical selling below a short-term ascending trend-line support on the 1-hourly chart.

Technical indicators have also started losing positive momentum and hence, a follow-through weakness, back closer to $1224 horizontal support, now looks a distinct possibility.

A convincing break below the mentioned support would confirm the bearish formation and pave the way for the resumption of the commodity’s prior depreciating move.

Spot rate: $1228

Daily High: $1235

Trend: Turning bearish again

Resistance

R1: $1235 (weekly tops)

R2: $1241 (horizontal zone)

R3: $1249 (July 12 swing high)

Support

S1: $1224 (horizontal zone)

S2: $1218 (weekly low set on Tuesday)

S3: $1212 (YTD swing low touched on July 19)