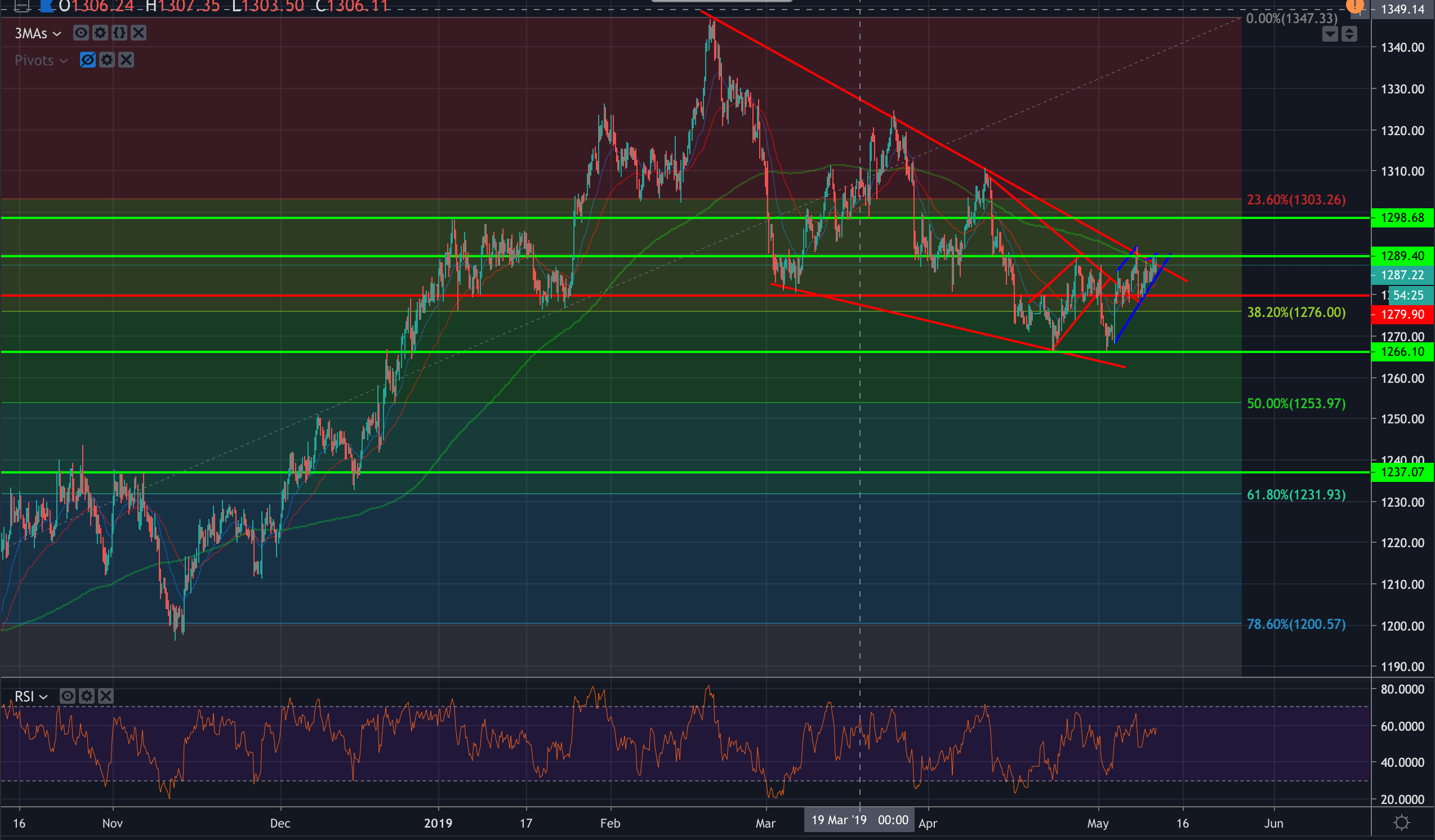

- The price struggles at trendline resistance that meets a prior major support level that now acts as resistance.

- Bulls still need a close above 1298 to negate the bearish bias.

- 1302.80 would be preferable but a feasible target on any further signs of disunity in trade negotiations and a prolonged trade spat.

- On the downside, below 1278 and then 1275 guards a run down to test the 1266 lows again ahead of where 200-DMA meets that 50% Fibo down at 1254.

- A breakdown there opens the 61.8% Fibo target at 1231 which meets the mid-Dec lows/Oct resistance.