- Gold failed to capitalize on the overnight solid rebound from the vicinity of the $1400 round figure mark and traded with modest losses just below multi-year tops.

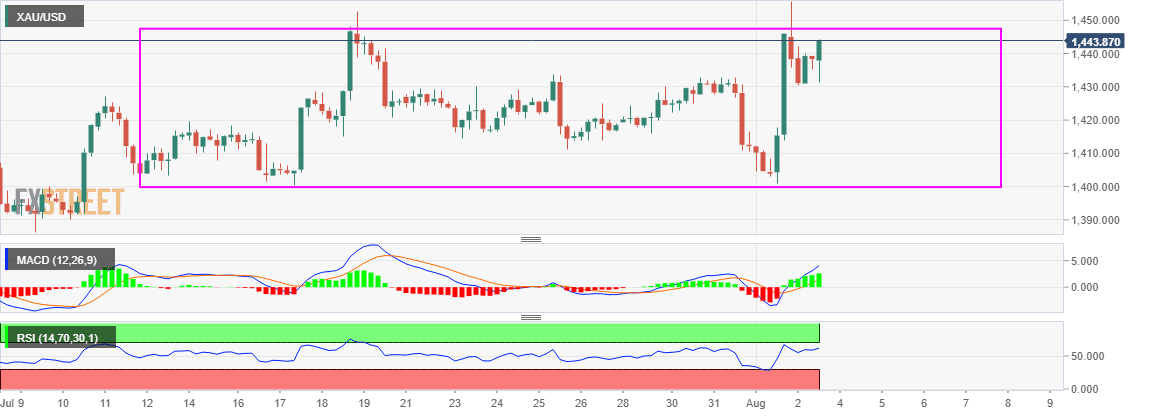

- The commodity has been oscillating in a broader trading range over the past three weeks or so, forming a continuation – rectangle chart pattern on the daily chart.

Rectangles – sometimes also referred to as consolidation zones, forms as a trading range during a pause in the trend and are usually considered as continuation patterns – bullish in this case, but sometimes mark a significant trend top, making it prudent to wait for a convincing break through the mentioned range.

The commodity remains well below its important moving averages – 50, 100 & 200-day SMAs, which coupled with the fact that technical indicators on the daily chart maintained their bullish bias, and are still far from being in the oversold territory, support prospects for an eventual break higher.

Sustained move beyond the $1448-50 region will reaffirm the constructive outlook and set the stage for a further near-term appreciating move $1478-80 intermediate resistance en-route the key $1500 psychological mark for the first time since April 2013 amid concers over a US-China trade war.

Alternatively, rejection from the current resistance zone now seems to find some support near the $1430 horizontal zone below which the slide could further get extended towards the $1414-12 intermediate support ahead of the mentioned trading range support near the $1400 handle.

Failure to defend the mentioned support levels might turn the commodity vulnerable to accelerate the slide further towards testing its next major support near the $1383-82 region, which if broken might pave the way for an extension of a meaningful corrective slide below $1350 level.

Gold daily chart