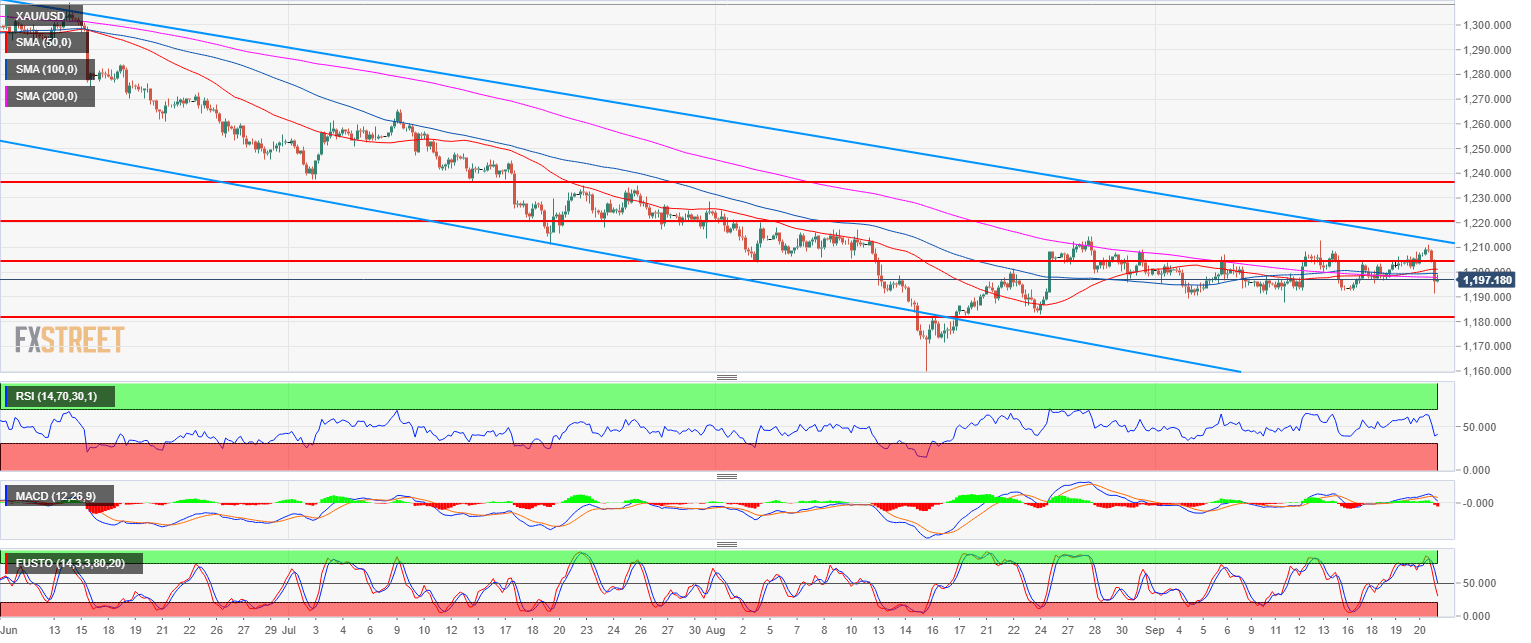

- Gold bear trend is on hold for the fifth consecutive week as the market is trading sideways.

- The 50, 100 and 200-period simple moving averages are coiled together as Gold is trading sideways. Gold has a neutral to bullish bias as long as it holds above 1,189.49.

- Bulls target can be located near 1,225.90 (July 17 low).

Gold 4-hour chart

Spot rate: 1,197.17

Relative change: -0.84%

High: 1,211.08

Low: 1,192.02

Trend: Bearish

Short-term trend: Bullish above 1,182.90

Resistance 1: 1,204.10, August 3 swing low (key level)

Resistance 2: 1,211.17 July 19 low

Resistance 3: 1,214.30 August 28 high

Resistance 4: 1,217.89-1,220.90 zone, August 6 high and July 18 low

Resistance 5: 1,225.90 July 17 low

Resistance 6: 1,237.60 July 3 swing low

Support 1: 1,194.30 March 10, 2017 low

Support 2: 1,189.49 September 4 low

Support 3: 1,172.82 current 2018 low

Support 4: 1,145.20 March, 1 2017 low