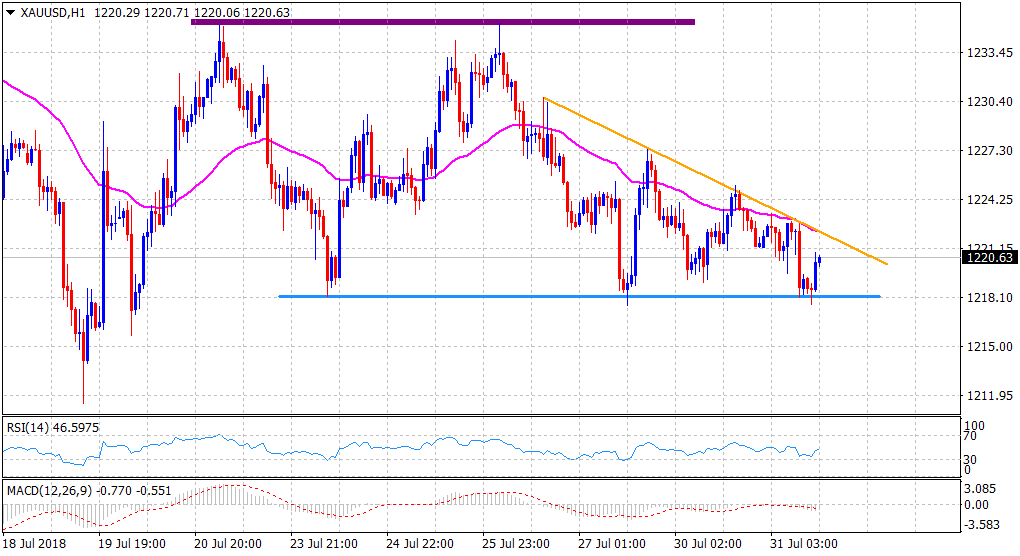

“¢ The commodity once again managed to bounce off the $1218 horizontal zone and was being supported by weaker USD/US Treasury bond yields.

“¢ Subsequent up-move, however, is likely to confront stiff resistance near a confluence resistance, comprising of a short-term descending trend-line and 50-hour SMA.

“¢ Technical indicators on the 1-hourly chart hold in negative territory and hence, the uptick might be seen as an opportunity to initiate fresh short positions.

Gold 1-hourly chart

Spot rate: $1220.63

Daily Low: $1217.67

Daily High: $1223.38

Trend: Bearish

Resistance

R1: $1222 (confluence region)

R2: $1225 (overnight swing high)

R3: $1232 (horizontal zone)

Support

S1: $1217 (over one-week-old horizontal support)

S2: $1212 (YTD low set on July 19)

S3: $1205 (July 2017 swing low)