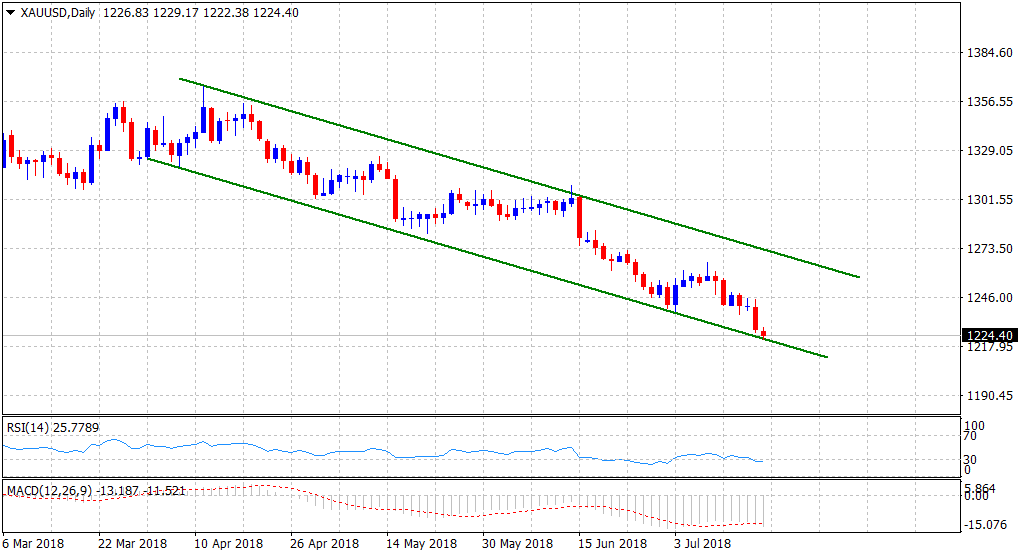

“¢ Overnight hawkish comments by the Fed Chair Jerome Powell remain supportive of resurgent USD demand and kept exerting downward pressure on the dollar-denominated commodity.

“¢ Yesterday’s fall below 200-week SMA marked a fresh bearish breakdown, with bears now looking for a subsequent weakness through a downward sloping trend-channel on the daily chart.

“¢ Daily/hourly RSI (14) point to highly oversold conditions, albeit has failed to lend any support and stall the ongoing bearish momentum to the lowest level since July 2017.

Spot rate: $1224.40

Daily Low: $1222.38

Daily High: $1229.17

Trend: Bearish

Resistance

R1: $1229 (current day swing high)

R2: $1234 (200-week SMA)

R3: $1238 (previous YTD swing low)

Support

S1: $1229 (July-14, 2017, daily closing low)

S2: $1220 (round figure)

S3: $1214 (horizontal zone)