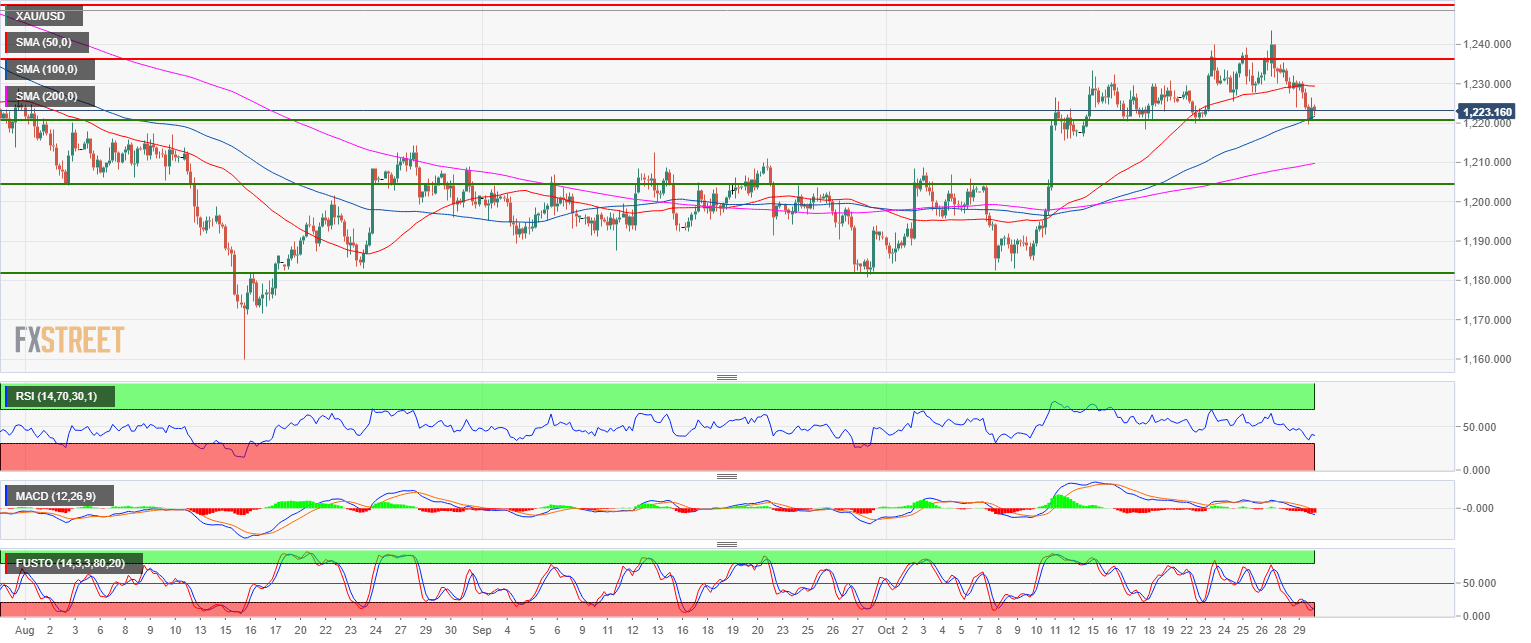

- Gold is trading in a bull trend above its 200-period simple moving average (SMA) on the 4-hour chart.

- Gold is currently retracing to the 1,220.90 support (July 18 low) and the 100 SMA. Bulls should try to support the market here.

- Alternatively, a break below the support can lead to a deeper pullback to 1,204.10 (August 3 swing low, key level). A break below 1,204.10 would likely invalidate the current bullish momentum.

Gold 4-hour chart

Main trend: Bullish

Resistance 1: 1,237.60 July 3 swing low

Resistance 2: 1,250.00 figure

Resistance 3: 1,265.90 July high

Resistance 4: 1,300.00 figure

Support 1: 1,220.90 July 18 low

Support 2: 1,211.17 July 19 low

Support 3: 1,204.10, August 3 swing low (key level)

Support 4: 1,182.90 August 24 low

Support 5: 1,172.82 current 2018 low

Additional key levels at a glance

XAU/USD

Overview:

Last Price: 1222.46

Daily change: -6.4e+2 pips

Daily change: -0.524%

Daily Open: 1228.9

Trends:

Daily SMA20: 1224.72

Daily SMA50: 1208.33

Daily SMA100: 1207.19

Daily SMA200: 1249.08

Levels:

Daily High: 1235.42

Daily Low: 1223.9

Weekly High: 1243.43

Weekly Low: 1219.9

Monthly High: 1212.64

Monthly Low: 1180.63

Daily Fibonacci 38.2%: 1228.3

Daily Fibonacci 61.8%: 1231.02

Daily Pivot Point S1: 1223.39

Daily Pivot Point S2: 1217.89

Daily Pivot Point S3: 1211.87

Daily Pivot Point R1: 1234.91

Daily Pivot Point R2: 1240.93

Daily Pivot Point R3: 1246.43