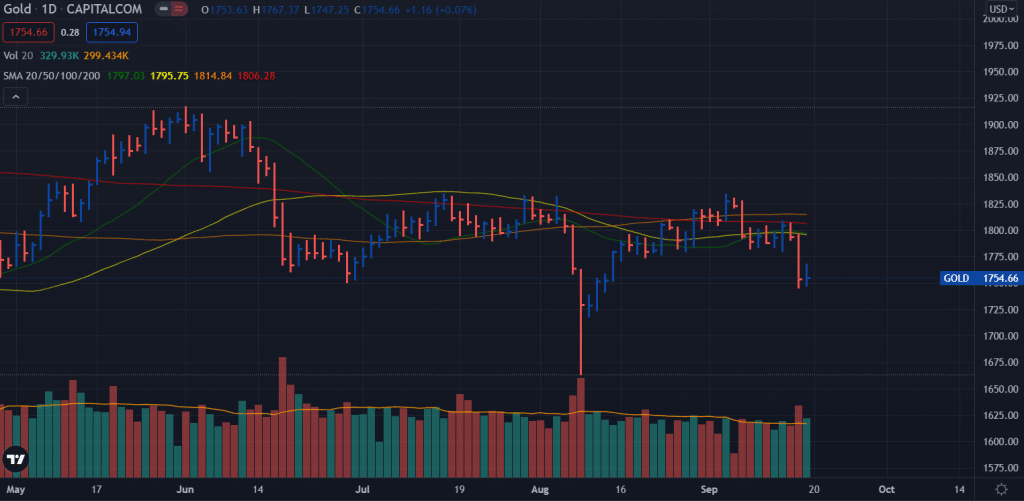

- In the second half of the week, the precious metal suffered heavy downward pressure and fell to its lowest level in a month at $ 1,745 on Thursday.

- Although the US Dollar Index (DXY) continued to decline, a risky environment prevented gold from continuing its bullish trend.

- A monetary policy decision and an updated forecast summary will be released by the Federal Reserve after its two-day meeting on Wednesday.

The gold price weekly forecast remains bearish as the US dollar remains strong after the strong retail sales figures pushed the Greenback up.

-Are you looking for the best CFD broker? Check our detailed guide-

A relatively calm start to the week was followed by Monday’s continuation of the horizontal channel from the previous week. Despite climbing above $ 1,800 on Tuesday, the precious metal suffered heavy downward pressure in the second half of the week and fell to its lowest level in a month at $ 1,745 on Thursday. The XAU/USD pair has struggled to make a convincing rebound ahead of the weekend, closing nearly 2% lower for the second straight week.

As expected, the US consumer price index (CPI) inflation fell to 5.3% y/y in August from 5.4% in July, according to US Bureau of Labor Statistics data released Tuesday. According to the report, excluding volatile food and energy prices, the core CPI fell from 4.3% to 4%, beating analyst estimates of 4.2%.

The dollar began weakening against all of its peers in the face of this imprint, which indicates that the Fed may not postpone its asset purchases. Thus, although the US Dollar Index (DXY) continued to decline, a risky environment prevented gold from continuing its bullish trend.

What’s next for the gold weekly forecast?

Gold will probably fluctuate between major technical levels on Monday and Tuesday as no major data will be released.

A monetary policy decision and an updated forecast summary will be released by the Federal Reserve after its two-day meeting on Wednesday. Policy makers’ projections for interest rates and inflation will be closely followed by investors. Additionally, the comments made at the press conference by FOMC Chairman Jerome Powell will be analyzed for additional guidance.

At the Jackson Hole Symposium, Powell acknowledged that he thought it would be wise to begin mining assets this year at the July session. Investors have overestimated the Fed’s shrinking prospects following several dismal reports since August, including disappointing non-farm jobs report that increased by 235,000 instead of the 750,000 markets expected. Powell, however, is unlikely to adopt a cautious stance based upon this week’s reports.

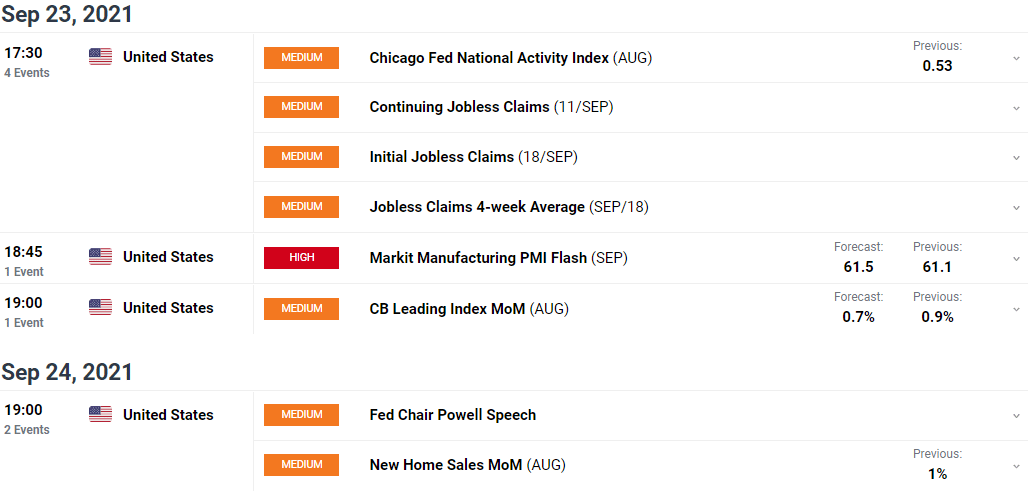

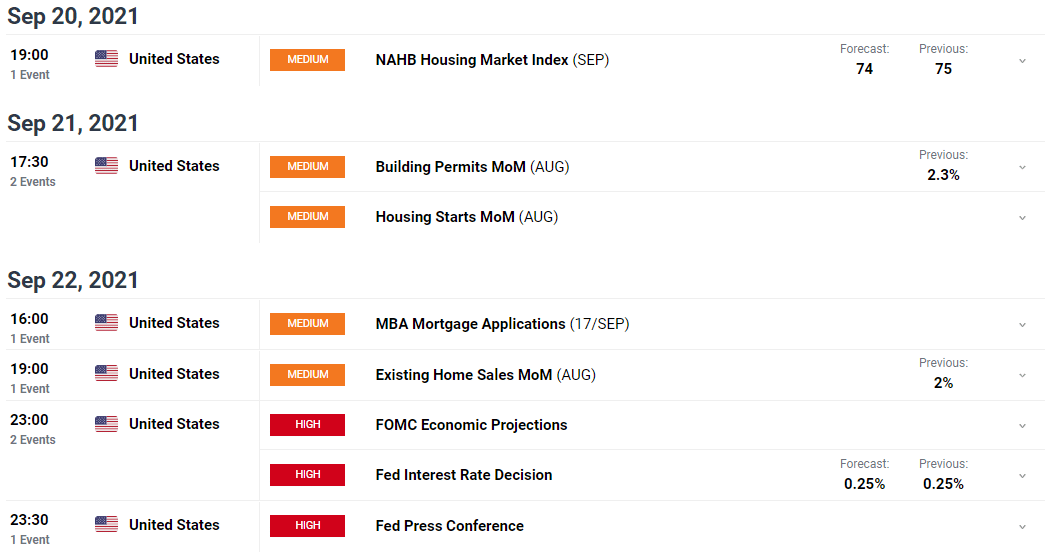

Key data events from the US next week

The week’s major event is the FOMC interest rate decision, followed by the press conference on Wednesday. Investors will likely look for clues of rate hikes and tapering from the press conference. The next important event is Market Flash PMI data on Thursday.

-Are you looking for forex robots? Check our detailed guide-

Gold weekly technical forecast:

Gold sharply fell on Thursday towards the monthly lows around $1,750 area. The price is well below the key SMAs. However, the SMAs are flat as the metal attempted to pare off some losses but remained failed to do so. The $1,800 level is the currency cap for the bulls, while the downside may find support around Aug 11 lows of $1,723. However, the price is currently standing at a strong horizontal support level that may trigger a mild pullback towards the $1,800.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.