- Gold price surges despite the firm US dollar.

- US bonds yields fell, resulting in a firm demand for gold.

- Gold may test the triple top and break if demand stays intact.

The gold price weekly forecast is bullish as the risk sentiment, and US yields keep favoring the precious metal. Gold hasn’t fallen amid firm USD.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

Early in the week, gold struggled to find direction, but late Wednesday evening, the market began to react negatively to the Fed’s political statements. XAU/USD rose significantly to $1,800 on Thursday following a sharp decline in 10-year US Treasury bond yields. It wasn’t difficult for gold to hold back its gains during the second half of the week despite the dollar’s strong performance against other major currencies.

ISM manufacturing PMI fell to 60.8 in October from 61.1 in September, according to US data. On the other hand, according to the ISM survey, the price paid component rose from 81.2 to 85.7, indicating continued upward pressure on production prices. However, XAU/USD remained in a consolidation phase, with investors taking a back seat to the Fed’s monetary policy decisions.

In line with expectations, the Fed left its target range for federal funds unchanged at 0% -0.25% and announced it would cut its asset purchases by $15 billion as of mid-November.

As government bond yields fell, gold gained momentum amid a recovery in the dollar. Currently, the positive correlation between the dollar’s market value and the yield seems to be fading. In addition, the return rate has a greater impact on XAU/USD than the dollar’s performance relative to other major currencies.

On Friday, the US Bureau of Labor Statistics reported that nonfarm jobs rose 531,000 in October, outpacing analysts’ estimates of 425,000. Gold remained strong, 10-year bond yields fell below 1.5%, and the dollar remained bullish after the data.

Key events/data for gold

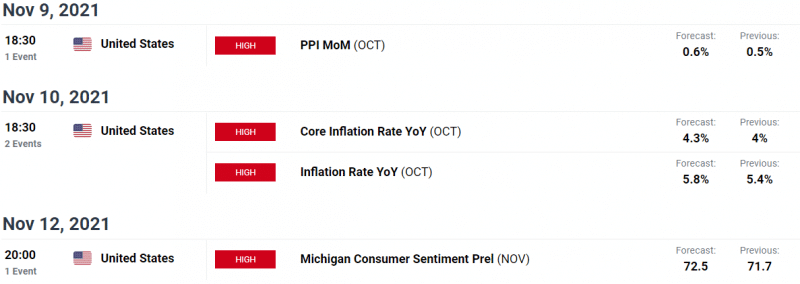

Investors will be paying close attention to US Treasury bond yields earlier this week, as there won’t be any high-level macro data released. The 10-year bond yield is currently below 1.5%, and if it does not rise above that level, XAU/USD could continue to rise. Alternatively, gold may lose interest if 10-year bond yields rise and stay above 1.6%.

Consumer price index (CPI) data for October were released on Wednesday by the US Bureau of Labor Statistics. A core CPI of 4% per annum is expected to remain unchanged, excluding volatile food and energy prices. However, in light of the Fed’s preference for the Consumer Spending Price Index (PCE), the market’s response to CPI data is likely to be limited.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

Gold weekly technical forecast: Tripple top to test

Gold price broker above all the key SMAs confluence around $1,800 area. The daily and weekly close above the $1,800 mark indicates a strongly bullish scenario. The yellow metal is now expected to test the triple top at $1,833. If the level is broken, we may see a surge to $1,860. On the downside, $1,800 will provide immediate support ahead of $1,792 and then $1,780.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.