- Gold (XAU/USD) risk reversals turned negative as prices dropped below $1,300.

- Negative risk reversals indicate increased demand for put options (bearish bets).

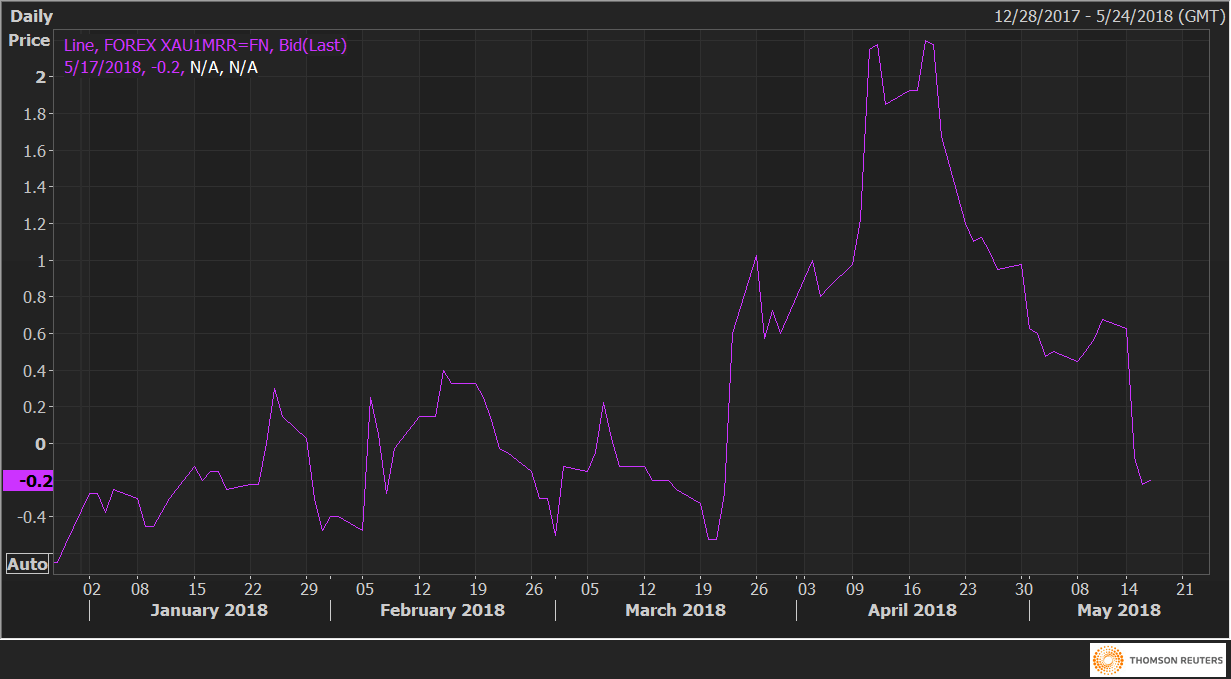

Gold one-month 25 delta risk reversals (XAU1MRR) fell into negative on Wednesday for the first time since March 22, indicating the implied volatility premium for puts is higher than that of XAU calls, i.e. puts are in demand.

As of writing, the risk reversals gauge was seen at -0.20 vs -0.225 yesterday and 2.2 on April 18.

The drop from +2.2 to -0.20 indicates the options market has turned bearish on the yellow metal, meaning the investors are expecting a deeper sell-off in the yellow metal and hence are hedging (preparing) for the same via long put positions.

The technical charts do indicate scope for a sell-off to $1,240.

XAU1MRR