The French elections are getting closer and every opinion poll moves the euro, with markets scared of Marine Le Pen. What does this mean for the euro and the pound?

Here is their view, courtesy of eFXnews:

Although data from the euro area this week painted an upbeat picture, with strong manufacturing PMIs and German ifo readings, French government bonds and the EUR remain under pressure, as investors’ remain focused on the upcoming French presidential election and the risk of a Marine Le Pen win. According to recent polls, it is still most likely that either the independent candidate Emmanuel Macron or the Republican François Fillon will become France’s next president. However, there is a significant risk the Front National (FN) candidate Marine Le Pen, who has threatened that France will leave the EU and the euro if she is elected, will win the presidential election. Nevertheless, even if Le Pen is elected, the road to an actual ‘Frexit’ is long. Whether Le Pen can or will actually hold an EU/euro referendum will depend largely on FN’s performance in parliamentary elections in June and support from her chosen prime minister. In our view, it is still questionable whether the public would vote in favour of leaving the EU/euro in such a referendum.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

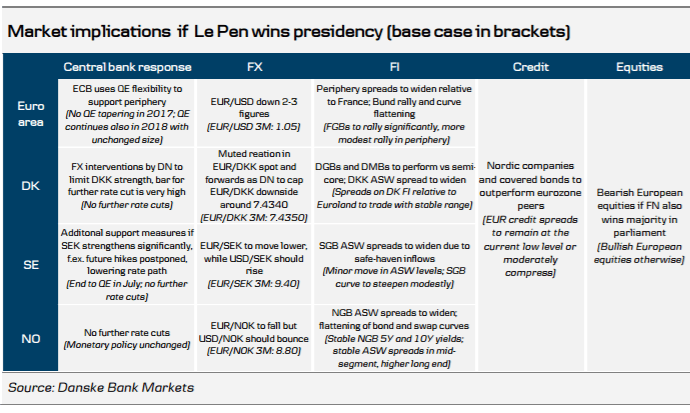

In terms of short-term market reactions following a Le Pen win (not a ‘Frexit’, which would have far more severe market implications), we expect the ECB to use its existing QE flexibility to support countries vulnerable to financial spillover, especially in the periphery, whereas support for France could be limited.

We expect to see a knee-jerk market reaction with a broad-based risk-off move triggering EUR periphery spread widening relative to France, a Bund rally and curve flattening, although the exact spread impact would depend on the ECB response. For the Nordic markets specifically, we are likely to see safe-haven inflows, with NGB/SGB/DGB ASW spreads widening.

In FX markets, we would expect the EUR to weaken versus other major currencies and EUR/USD to settle 2-3 figures lower. In our view, the GBP could be one of the top performers if Le Pen wins the election, due to an increase in the EUR risk premium and a decline in the Brexit risk premium priced on GBP.