The US dollar reversed its gains following the dovish statement from the Fed. Was this an overreaction an opportunity to sell EUR/USD as some suspect? Or perhaps there is a real change?

According to the team at JP Morgan, this now infects the dollar’s path.

Here is their view, courtesy of eFXnews:

“While the needle hasn’t moved much on the directional view, we think greater uncertainty now infects the Fed track and hence the dollar’s path. For one, the Fed’s selfprofessed data dependency has been heightened in import due to references to growth risks from the currency.

...A larger set of decision-making inputs with potentially conflicting signals opens up room for greater uncertainty, as does their relative rank ordering in the Fed’s framework – inflation has clearly climbed the variable hierarchy and the dots assume a bigger role in Fed communication than earlier, but whether this will still remain the case if/when data surprises begin to reverse their current disappointing streak bears close watching.

Additionally, as a result of the sharp adjustment in the dots, all three aspects of the Fed funds path – the timing of lift-off, the pace of hikes and the terminal rate – are now open to re-appraisals. This elevated uncertainty is perhaps why gamma swaptions in US rates have atypically firmed even after the passage of the Fed event risk, and spillover onto FX vol over the next few months is likely given how tight rates/FX links have been through this cycle.

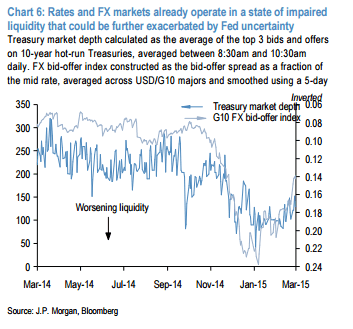

Rates and FX markets already operate in poorer-than-normal liquidity conditions that can be further exacerbated by Fed uncertainty, so the stage is set for a noisy run-in to a mid-year lift-off that is not conducive to cavalier directional risk – the macro portfolio remains light on risk, most of it in option format.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.