We are beyond the June 30th deadline with Greece missing the IMF payment and the bailout having expired. What’s next?

The team at Goldman Sachs analyzes the situation and explains what scenario could lead EUR/USD to near parity on the Greek crisis:

Here is their view, courtesy of eFXnews:

In a special note to clients today, Goldman Sachs weighted on EUR/USD puzzling price action in-reaction to the news of the Greek referendum. The following are the key points in GS’ note along with its latest EUR/USD forecasts.

“This week’s jump in the Euro on news of the Greek referendum made no sense to us. As always, there are competing ex post explanations for what happened, but we see two things at play,” GS argues.

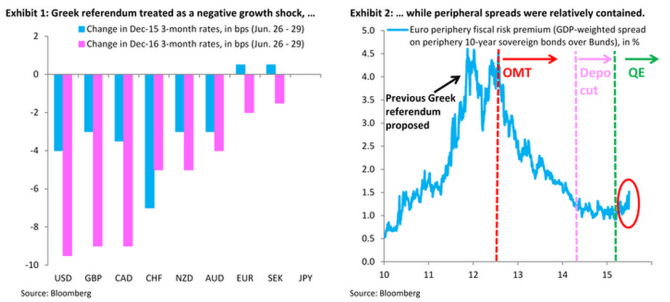

“First, the market treated developments in Greece as a negative global growth shock, with rates markets pricing out hikes in those places seen as closest to lift-off. That penalized the US and the UK most of all and pushed rate differentials in favor of the Euro. We fail to see how mounting tensions around Greece do anything other than reinforce US outperformance over the Euro zone, i.e., we see this price action as a fade,” GS clarifies.

“Second, after years of cliff-hangers, the market continues to expect a deal at the last minute, including in the aftermath of the referendum announcement. As a result, few are willing to put on Euro downside, even as the odds of a deflationary shock to the Euro zone are rising,” GS adds.

“We continue to see mounting tensions over Greece as a catalyst for EUR/$ to go near parity, if contagion to other peripherals causes the ECB to accelerate QE,” GS concludes.

“We continue to forecast EUR/$ at 0.95 in 12 months,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.