The Greek crisis seems to be heading to a showdown on Sunday’s EU Summit.

But regardless of the results, the team at Danske see a sell opportunity:

Here is their view, courtesy of eFXnews:

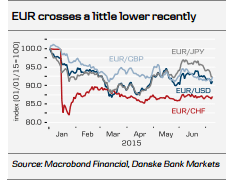

The Greek ‘No’ sent EUR crosses lower but the initial move has already partly reversed. We see two main reasons for the limited reaction in the FX market: (1) should a Grexit materialise it would not be a ‘Lehman’ scale event, and/or (2) FX markets have learnt an important lesson from the currency war of H1, i.e. that central banks are highly alert to currency moves.

Lately in relation to a first Fed hike the concerns of the FOMC have concentrated on the impact on financial conditions of the Greek fallout. This leaves us in a situation where the near-term direction for EUR/USD is down no matter what the Greek outcome.

If a Grexit is avoided, the Fed is on track to hike sooner rather than later providing support to the USD. If a Grexit arrives, the ECB will signal its readiness to act (but may not actually have to deliver more QE) and weaken the EUR. However, in either outcome, support will be concentrated on one leg, which suggests that parity for the cross is still not within reach.

We see the cross at 1.04 in 3M. Note also that the current downward pressure on oil prices is another potential source of EUR weakness: the oil price fall limits the scope for a rebound in eurozone inflation over the autumn, everything else being equal. This could in turn fuel expectations that the ECB needs to do more to steer the euro area away from lowflation.

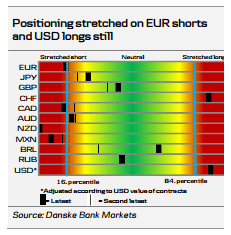

Speculative accounts should maintain short EUR exposures against other majors; notably we see potential in CHF in the event of a Grexit and recommend being short EUR/CHF if Greece goes. Grexit or not, we see good but different reasons for EUR/USD to head lower. We are short EUR/USD in our Danske FX Trading Portfolio.*

*Danske maintains a short EUR/USD from 1.1119 targeting a move to 1.02.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.