And it happened again. I feel like it happens every trading year. We’re moving along just fine and then before you know it, you blink and the holidays are here.

Over the years, I feel like I’ve heard it all. Some traders say to never trade during the holidays, others say that it’s the ideal time to trade”¦ It seems like this too is another one of those trading situations where everyone tells you something different.

By Joshua Martinez, Market Traders Institute, Inc.

I have one major trading rule that helps me make up my mind on holiday trading and it’s something I bet you’ll agree with; Family comes first, trading comes second. That’s a truth that I refuse to make exceptions for. Now, does this mean that we stop trading halfway through the year in anticipation for the holidays? Well no, but there is a stopping point and a set of rules that I have for my trades leading into the holidays for very specific reasons as well as some keys to knowing what to expect and how you could react to the grip that the holidays have on the market. Let me explain:

Rule #1: Look for Directional Moves in Early December

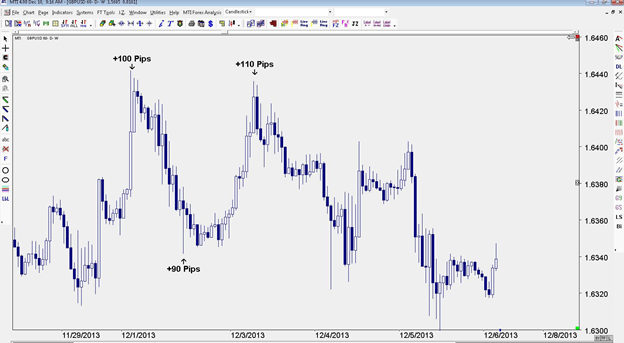

The first two weeks of December are ideal for trading. Between December first through, let’s say, December 12 or 14, we’ve historically seen directional, unilinear movements carried out over the span of one trading day. Almost every day leading up and until that halfway point in the month of December, we see single-direction movement which typically makes finding entry and exit points for 50- to 100-pip wins simpler. You can typically trade these in such a way where you cash out your returns that very day. This is that sort of “easy money” trading time that traders like to jump on. Don’t believe me? Let’s look at the charts. In Figure 1, we see December 2013. In 17 hours (within one trading day), the market fell for 100 pips. Better yet, the market turned around and did the same thing again for 90 pips the very next trading day. Needless to say, the first two weeks of December can be a great time for traders to top off their trading returns with some quick wins.

Figure 1:

Rule #2: Look for Tell Tale Candlesticks

Directional movements are great, but you have to get your sights on what to look for in identifying those moves early. With movements only lasting a day or so during this time of the year, you want to zero in on the candlesticks that warn that a strong directional move is in progress. Some candlesticks to be wary of during this time of the year are tweezer bottoms, tweezer tops, engulfing bullish candlesticks, engulfing bearish candlesticks, shooting stars and dark clouds.

Rule #3: Take the Time to Get Technical

I’ve found that the key to making money during the holiday trading season is to stick to the technicals. The Fibonacci sequence can help you technically identify daily direction and pinpoint entry points and exit points. Additionally, hand-drawn trendlines are crucial. Make sure to identify support and resistance levels that will make directional movements stand out off of the chart so that your trading decisions are that much more clear.

Rule #4: Call it a Year Early

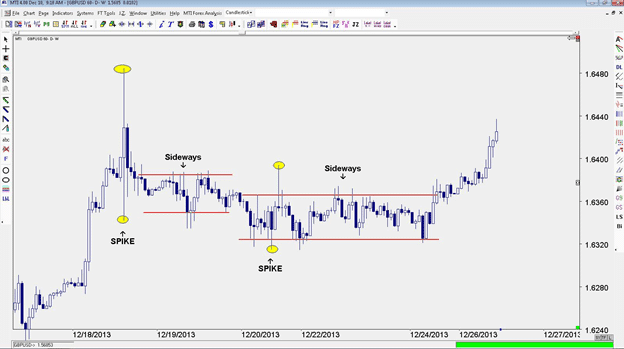

Now, you’re probably saying, alright, that’s the first two weeks of the year, then what? Why the cutoff? This is because of Figure 2. As the holidays inch closer, the market becomes plagued with “wild candlesticks” or, in other words, a lot of sideways movement before exploding with one to two monster candlesticks that make up the majority of pips you’re chasing. Not only are these candlesticks erratic, they can be very dangerous to the capital preservation that is critical toward the end of the year. One of my major trading philosophies deals with not forcing trades. I trade when the purpose and goal of the trade is clear and when I’m confident. If I can’t say that those two standards are true, I sit things out. You never lose money in trades you don’t place.

Figure 2:

With these wild candlesticks, finding entries and exits can be more than a chore; it can be nearly impossible. This is why I prepare my mind and trades so that I don’t feel the need to trade during the final two weeks of the year.

Rule #5: It’s Okay to Get Defensive

That’s right. I said it. Don’t be afraid to get defensive with your trades right before the new year. When the year’s almost over and you’re looking at potential trading opportunities, you don’t have to be a hero. Get defensive about the returns you’ve already made and focus on capital preservation. Minimize the risk you take and don’t force trades that unnecessarily put the returns you made throughout the year in danger.

Whether we like it or not, the end of the year is coming and that could mean changing up our trading plans. Once we look at the historical data, it’s much easier to decide what our trades should look like during this time of the year and with a solid plan, you could finish the trading year strong.