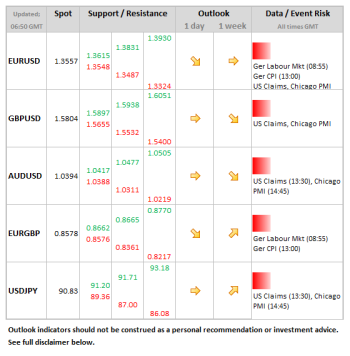

- EUR: In terms of economic data, last year was a reversal of what has been normal for the single currency period, with markets more sensitive to events in the periphery than Germany. This is balancing out, as peripheral yields have declined, so single currency could be bolstered by signs of strength in Germany (lower unemployment). That said, more unpredictable month-end flows will dominate.

- USD: There was limited dollar reaction to the weaker GDP data yesterday, which shows that data is taking a back seat and this especially the case on the last trading day of the month.

Idea of the Day

The lack of reaction from the dollar yesterday to the (marginal) fall in GDP illustrated the extent to which the market is more focused on positioning and month end flows rather than the economic fundamentals. This was also the ‘best’ fall in GDP ever seen, with the market buying into the one-off factors (e.g. the slump in defence spending) that helped to explain away the decline. The fact that this is the last trading day of what has been a pretty volatile and exciting month for FX is likely to cause some further volatility relating to month-end flows, with US labour market data tomorrow also likely to keep the market on edge tomorrow.

Latest FX News

- USD: There were no great surprises with the FOMC meeting last night, with a few marginal adjustments to the statement. The dollar held steady overnight and starts the European session marginally firmer.

- JPY: Some consolidation emerging within the uptrend on USDJPY, with volatility having fallen in the past few days. Not that surprising given the extent of the recent moves and the greater amount of two-way traffic between bulls and bears. Labour market data will be the focus on Friday.

- NZD: The central bank was sounding hawkish and suggesting the NZD was overvalued and undermining export profitability. USDNZD nudged from 0.83 to 0.8360.

- GBP: The latest GfK consumer confidence data showed a modest rise in January, from -29 (the average of the past 12 months) to -26. Note that bond yields are close to making 8 month highs above 2.12% on the 10 year bond.

Further reading: After the Fed, EUR remains overbought