- China’s new security law and the slow Sino-American decoupling risk Hong Kong dollar peg.

- Hong Kong is the world’s No. 3 financial center and a break of the 36-year peg could cause jitters.

- The unpegging, if it happens, may occur while the world is distracted.

The Swiss National Bank vowed to uphold the EUR/CHF peg – only to release the “SNBomb” several days later, removing the 1.20 floor under the cross. The unpegging wreaked havoc in markets and sent some forex brokers to bankruptcy.

The SNB’s peg held up for around 3.5 years, and the peg of the Hong Kong Dollar to the greenback is alive and kicking for 36 years – since 1983. Eddie Yue, chief executive of the Hong Kong Monetary Authority (HKMA) referred to the peg in a blog post on June 2:

It is a pillar of Hong Kong’s monetary and financial systems and will not be changed because of any shift in foreign policies towards Hong Kong.

Famous last words? Tensions are rising

Yue is referring to growing tensions around the city-state. China has tightened its grip on Hong Kong by passing a controversial security law, undermining HK’s independent rule of law and “one country, two systems” principle regarding its governance since 1997.

The move from Beijing comes after months of protests in Hong Kong in 2019, as the world is consumed with the coronavirus crisis, and with rising Sino-American tensions. The world’s largest economies are at loggerheads over COVID-19, Chinese tech, the future of Taiwan, human rights in Chinese western Xinjiang province – and also trade.

The US reacted with anger with Secretary of State Mike Pompeo leading the charge. The outspoken senior official certified to Congress that Hong Kong is no longer autonomous.and raised speculation that he may push to void the US Act from 1992, granting the city-state a special status.

The risk for the peg is that the US would limit Hong Kong banks from accessing greenbacks, severing links, and triggering chaos.

Why the peg is critical

Investors have been ignoring these elevated tensions as long as both countries withhold the trade agreement. While Hong Kong does not produce as much as it did in the late 1990s, its importance to financial trade has risen significantly since then.

Hong Kong is the middle ground between the US and China, with investments pouring into China via the financial hub. 73% of the city’s stock market value is of companies from the mainland, and nice of China’s top firms are listed there.

Hong Kong firms have special access in the US, such as HK firms receiving similar treatment to American peers by US derivatives regulators. That is far from privileges Washington would ever grant to Beijing.

As a financial hub for foreign exchange, HK is overshadowed only by London and New York, serving as the third-largest place for trading USDs. Greenbacks changing hands in the city-state are fungible with those moving around in New York.

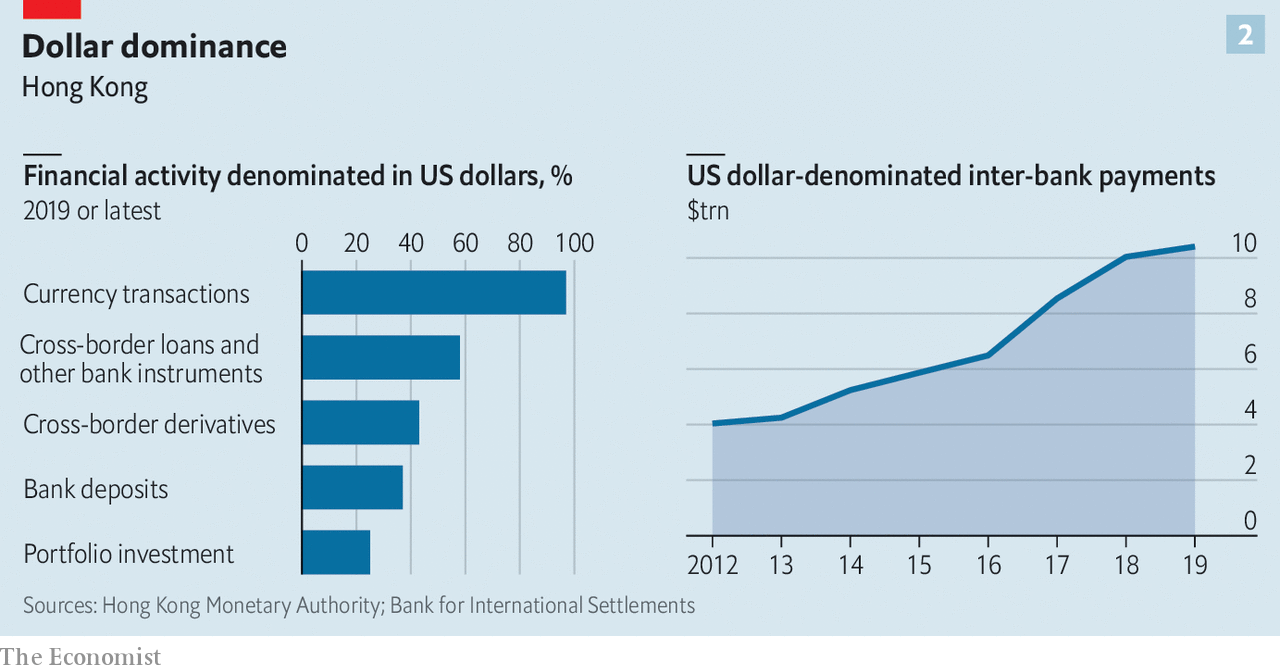

Its importance has been rising in recent years:

Source: The Economist

Total payments passed through Hong Kong are worth around $10 trillion and the total stock of cross-border claims is around $4 trillion. These are vast sums for territory with only around 7.5 million inhabitants. No fewer than 163 banks are licensed in Hong Kong, with three out of the top five being Western-based ones.

There is no wonder that both HSBC and Standard Chartered expressed support for China’s security law, trying to calm tensions – yet triggering fury from Pompeo.

Unraveling the decades-long peg may, therefore, trigger financial chaos in China, the US, and across the world. And that is why it will likely be defended.

How the peg can be defended

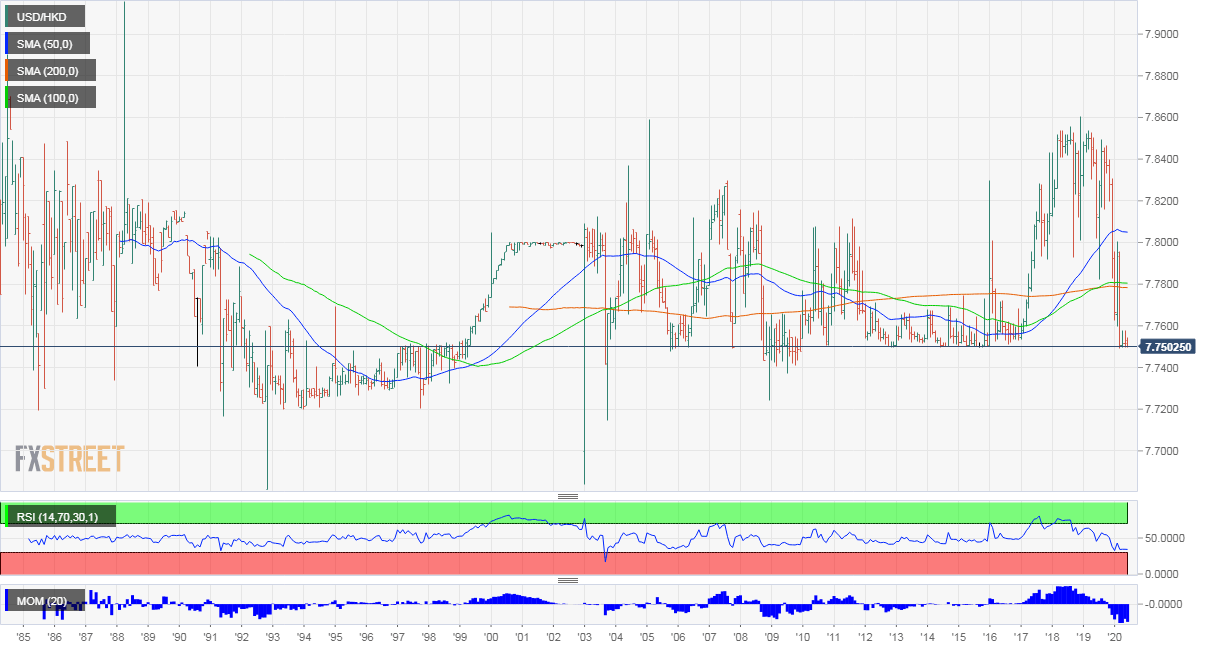

The central bank has been maintaining a range of between 7.75 to 7.85 for HKD/USD by buying and selling the local currency and by following the Federal Reserve’s monetary policy.

Another means of keeping the HKD strong and stable is by holding the Hong Kong Interbank Rate (HIBOR) above the equivalent US LIBOR. That helped alleviate concerns in the financial crisis and during current tensions.

Power of persuasion: Attempts to calm markets can backfire – talking about a problem may turn into a self-fulfilling prophecy. On the other hand, there is room to be optimistic as Hong Kong, Chinese, and American businesses have considerable room to lose if the peg breaks. Authorities in the financial hub may convince the US and China to refrain from touching the HKD peg.

Arm chest: The HKMA has a whopping $440 billion in reserves in foreign reserves, more than double the value of local money supply. The mere existence of this stash of cash is sufficient to deter speculators – at least in normal times.

Money from China: If these foreign reserves are insufficient, the HKMA clarified that it can request assistance from the People’s Bank of China.for additional support. This extra backing would stem a stampede and serve as a second deterrent.

Nevertheless, the levee can always break under extreme conditions.

How could it break?

Generally speaking, it is all a matter of trust. If money begins flowing out, it could turn into a tide. Kyle Quindo of Blackbull Markets Limited looks at historic examples of breaking pegs, and the one of Thailand, also in Asia, is a good comparison of how reserves drained out slowly until the peg collapsed at once:

This was the case in the Thai Bhat in 1997 and the Argentinian Peso in 2000. In the case of the Thai Bhat, Thailand was experiencing high levels of growth from 1992 onwards as banks loosened restrictions, causing a lending boom and inflated real estate prices. However, from 1995 onwards, growth slowed, with investors increasingly worrying about the returns on their investments. This caused a massive capital outflow out of Thailand, devaluing the Thai Bhat. The government tried to prop up the currency by using its $38B USD foreign reserves. However, in half a year from the start of 1997, their foreign reserves dropped 93% to $2.65B before they stopped the regime.

Another impressive chart from the article is that of the Argentinian peso in the early 2000s, showcasing how something seemingly rock-solid disappeared at once:

USD/ARS, do read the full article.

How can capital outflow be triggered?

By the US, an election stunt

President Donald Trump is facing a tough reelection campaign amid the coronavirus outbreak, racial tensions, and his failure to unite the country. One of his winning cards in 2016 – and something Americans agree on – is being tough on China.

Pompeo and senior adviser Peter Navarro are pushing for a harder line against Beijing and may convince Trump to abandon the 1992 Hong Kong Act or any other means of maintaining tight financial ties. The potential gamble would be that sticking it to China would distract from other issues and unite the nation.

The chances remain low but the risk is huge. If this were to happen, the timing would likely be closer to the elections in November.

By China, after preparation, during a distraction

Beijing could also take preventative steps to rid itself of its dependence on finances in Hong Kong amid the ongoing frictions with the US. To do so, it would first have to build more trust in its own exchanges, a lengthy process.

Promising transparent and fair legal systems is insufficient to convince companies to list in Shanghai or Shenzhen. Confidence building takes time and China is in deficit amid the coronavirus crisis. Access to US dollars is also problematic is the provider of greenbacks – the US – is not cooperating.

Nevertheless, as the world’s second-largest economy, China has clout all over the world and may move toward ridding itself from financial dependence on HK, as it did with moving away from economic dependence. That may take years – Beijing is playing the long game – and only afterward it may shock the world by getting rid of the peg.

The moment to do so would likely be during a big event. Russia invaded Georgia when the world was watching the opening ceremony of the Beijing Olympics. India voided 86% of bills in circulation when the world was fascinated with the US 2016 elections.

And it may happen when markets are fully open – the Swiss National Bank dropped its bomb at 10:30 local time on a Thursday, when European markets were open.

Conclusion

The 36-year Hong Kond Dollar peg is coming under some strain amid worsening Sino-American relations. While the local currency seems insignificant for the world, the city-state’s function as the world’s No. 3 center for foreign exchange and its role as a conduit between the US and China make such a potential collapse monumental.

The probability of such a move are low, but the ramifications could be massive. The US presidential elections in November pose the highest risk for the narrow 7.75 to 7.85 USD/HKD range.